Facilitate payments on your platform

Stripe Connect helps the world’s most successful platforms – such as Shopify, Mindbody, and DocuSign – launch, scale, and differentiate a profitable payment business.

Deeply integrated payments

Embed payments into your software platform for a seamless user experience – from onboarding to payouts.

New lines of revenue

Monetise payments on your platform through markup or revenue share and add new lines of business with additional products like in-person payments and automated tax calculation and collection.

Launch faster

Go live faster with a single global integration that minimises operational complexity and development resources.

Built for scale

Whether you’re just getting started or onboarding millions of customers, Stripe makes it easy to integrate and add more features as you grow.

Integrated payments experience

Create your own payments service

Make your software platform more valuable to customers by embedding Stripe’s powerful payments technology. Connect helps you offer payments as a service to your customers and get up and running quickly.

- No-code setup for your customers

- Single, global platform for accepting all payments

- Frictionless one-click checkout with Link

- Fast payouts

- Co-branded with Stripe or fully white-labelled

Online and in-person payments

Fareharbor partnered with Stripe to let its tour and activity operators accept online and in-person payments. It uses Stripe’s conversion-optimised UI to easily onboard and verify businesses in 20+ markets around the world.

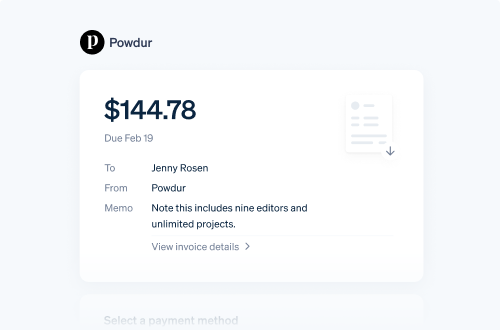

Invoices and online payments

Xero partnered with Stripe to let businesses add a “pay” button to their invoices to collect online payments instantly. By adding payments to invoicing, Xero helped its customers get paid up to 15 days faster.

Tax automation

Thinkific partnered with Stripe to enable their creators to calculate and collect sales tax on global transactions. By adding tax automation to payments, Thinkific helped their creators reduce risk, prepare tax filings and reports, and streamline compliance.

Subscriptions and loyalty programmes

Spotify partnered with Stripe to help podcasters launch recurring revenue streams and deepen their connection with fans with a seamless subscription sign-up experience.

Add lines of revenue

Monetise payments on your platforms

In addition to being a useful feature for your customers, payments can be a revenue stream and competitive advantage for your platform. Stripe can help you monetise payments and add new lines of business with features like in-person payments, tax automation, subscriptions, lending, and more.

Global scale and compliance

Accelerate international expansion

Reduce compliance risk

Requirements for payments facilitation vary significantly by country, business model, and transaction type. Stripe can help manage the complexity of compliance, licensing, and card network rules, so you can expand faster and decrease operational overhead. Connect automatically updates to help meet the latest payments compliance requirements – without any changes required to your integration.

Go live around the world faster

Reach customers around the world and enable payments acceptance with one integration – no need to establish local entities or banking relationships. Launch in new countries using the same API and with no additional development work. Platforms powered by Connect get out-of-the-box access to hundreds of global Stripe Payments features.

Case studies

Thinkific partners with Stripe to boost creator revenue and simplify back office operations

Thinkific is a software platform that gives educators the tools they need to turn their unique genius into a sustainable business. Thinkific turned to Stripe to further support educators to drive more sales and scale their business.

Solution

Thinkific allows educators to easily process payments on its platform, optimise conversion and increase average order value, and reduce the burden of tax compliance.

Impact

Thinkific Payments recently surpassed $100 million in payments volume processed to date, with over $29 million processed in the last quarter alone.

Products

Stripe allows us to turn on new markets instantly and move at the pace that meets our customers’ growing and changing needs. I'd estimate we move twice as fast as we would with any other platform.

Mindbody uses Connect to unify online and offline payments

Mindbody builds business management software that serves gyms, spas and salons worldwide.

Solution

Mindbody integrated Connect and Terminal to enable its customers to accept payments online and in-person. Using Stripe’s global platform, Mindbody was able to extend its global footprint to Hong Kong and Singapore.

Impact

With Stripe, Mindbody was able to expand to new regions faster while keeping its engineering resources focused on its core wellness product.

Products

Stripe’s value is they are a true partner, helping us roadmap our global expansion and work through local challenges. You don’t often see this type of strategic partnership with other payment vendors.

Jobber uses Connect to simplify payments

Jobber helps home service businesses organise and run their operations.

Solution

Jobber partnered with Stripe to launch Jobber Payments, which allows its customers to easily collect payments at every stage of a home service project without needing to write any code.

Impact

Jobber’s customers appreciate moving away from paper cheques and now get paid in hours instead of weeks.

Products

DocuSign uses Connect to add a new line of business

For years, DocuSign customers had requested the ability to collect signatures and payments in one step.

Solution

DocuSign partnered with Stripe to launch DocuSign Payments, making it possible for customers to request payment within the signature process.

Impact

With Stripe, DocuSign was able to add a new line of revenue and attract new customers who need to accept payments as part of the signature process.

Products

Try Connect

Learn how to use Connect to integrate payments into your platform

Embed payment workflows quickly using Connect’s prebuilt UIs, including:

Solutions for platforms

Platforms are using Stripe to help their customers add subscriptions, protect against fraud, access capital, and more.

Pricing for any business model

Usage-based and flexible with competitive rates.