ASC 740 Tax Provision Guide

Find answers to common technical questions and process challenges that arise when calculating your ASC 740 income tax provision.

Calculating the ASC 740 provision for income taxes can be a difficult technical challenge for tax practitioners. The market’s most powerful tax provision software provides an accurate calculation, intuitive design, and thorough footnotes. See how Bloomberg Tax Provision untangles ASC 740’s complexity.

Calculate your ASC 740 tax provision accurately and efficiently

Bloomberg Tax Provision is the most powerful ASC 740 calculation engine on the market. Our software solves the technical and process issues involved in calculating your income tax provision – taking manual risks out of the equation.

Accurate calculations

Efficiently and accurately address the entire range of complex ASC 740 technical topics – including uncertain tax benefits (UTBs), ARB 51, quarterly annual effective tax rate (AETR) calculations, robust state computations, and income tax payables.

Intuitive design

Seamlessly upload your spreadsheet workpaper data with our tax provision software to leverage the work you’re already doing in a layout that’s simple and self-explanatory.

Controlled workflow

With a full audit trail, including review features and user permissions management, you control all aspects of your tax provision process.

What is a tax provision?

An income tax provision represents the reporting period’s total income tax expense, including federal, state, local, and foreign income taxes. ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. This applies only to taxes based on income – not sales, payroll, or property taxes – per ASC 740-10. The ASC 740 income tax provision consists of current and deferred income tax expense.

Current income tax expense (benefit) includes the income tax payable (receivable) for the current period based on applying current tax law to current period taxable income or loss.

Deferred income tax expense (benefit) represents the anticipated future tax expense (benefit) from activity in past or current periods. This future deferred income tax expense (benefit) arises from temporary differences between book and tax value for certain items.

ASC 740 applies to all entities but only to entity-level income taxes. Pass-through tax provisions only occur for jurisdictions with income-based taxation at the entity level. Thus, calculating the ASC 740 provision for income taxes usually concerns only C corporations.

Deferred tax asset valuation allowances

ASC 740-10-30-18 states that future realization of the tax benefit of an existing deductible temporary difference or carryforward ultimately depends on whether the company has sufficient taxable income of the appropriate character (for example, ordinary income or capital gain) within the carryback/carryforward period available under the tax law.

Sources of taxable income under ASC 740

The following four possible sources of taxable income may be available under the tax law to realize a tax benefit for deductible temporary differences and carryforwards:

- Future reversals of existing temporary differences.

- Future taxable income exclusive of reversing temporary differences and carryforwards.

- Taxable income in prior carryback year(s) if tax law permits carryback.

- Tax planning strategies (see paragraph 740-10-30-19) that would, if necessary, be implemented to, for example:

- Accelerate taxable amounts to utilize expiring carryforwards.

- Change the character of taxable or deductible amounts from ordinary income or loss to capital gain or loss.

- Switch from tax-exempt to taxable investments.

How to calculate corporate income tax provision under ASC 740

ASC 740 income tax provision formula

Add the current and deferred income tax provisions to get the total ASC 740 income tax provision:

Current tax provision + Deferred income tax provision = Total ASC 740 income tax provision

Current income tax provision = taxes reported on current year returns (if available) + any adjustments for prior year returns.

However, the current income tax provision must exclude uncertain tax benefits except to the extent the relevant tax authority will more likely than not sustain the underlying position.

Companies may estimate the current income tax provision to issue financial statements before filing the related tax return.

How to estimate the current income tax provision

- Start with pre-tax GAAP income.

- Add or subtract net permanent differences.

- Add or subtract the net change in temporary differences.

- Subtract usable loss carryforwards.

- Multiply the result by the income tax rate (21% for federal tax on C corporations).

- Subtract usable tax credits, tax credit carryforwards, and the benefit of current year loss carrybacks.

- Adjustments for prior year returns and uncertain tax benefits also apply to an estimated current provision.

ASC 740 mandates a balance sheet approach to accounting for income taxes. Companies recognize and measure deferred tax liabilities and deferred tax assets plus any required tax valuation allowances, then use the changes in these accounts to calculate the corporate deferred income tax provision.

How to calculate the deferred income tax provision

Multiply total taxable temporary differences by the expected tax rate at the time the differences will reverse – based on currently enacted law – to calculate the deferred tax liability. Repeat this step with deductible temporary differences and loss carryforwards – then add total tax credit carryforwards – to obtain the deferred tax asset.

Next, create a deferred tax asset valuation allowance for the portion of the deferred tax asset with no more than a 50% chance of realization. Record the effect of uncertain tax benefits on deferred tax assets and liabilities.

The deferred income tax provision (benefit) equals the net deferred tax liability (asset) at the end of the year minus the net deferred tax liability (asset) at the beginning of the year.

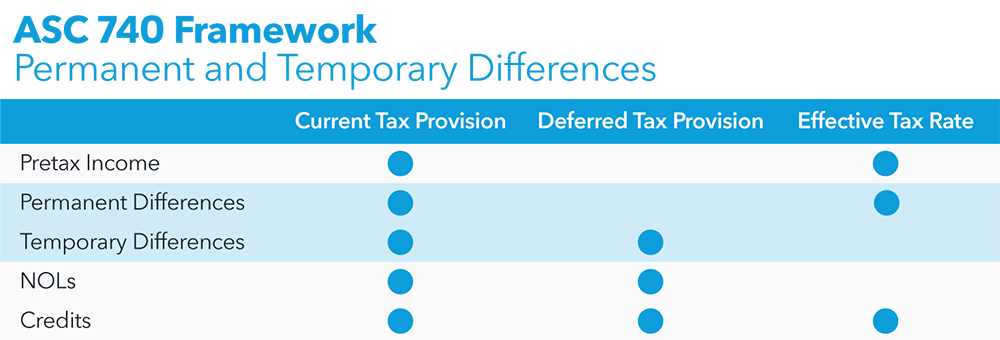

Permanent vs. temporary differences between GAAP and tax income

Permanent differences between GAAP and tax amounts never reverse. GAAP income excluded from tax, nondeductible expenses, and the effects of certain credits all represent permanent differences.

For federal income tax, examples include:

- Interest on state and municipal bonds (tax-exempt income).

- Entertainment expenses (nondeductible expenses).

- Fines (nondeductible expenses).

Permanent differences affect the current provision and, therefore, the effective tax rate under ASC 740. They do not create deferred income tax assets or liabilities because they never reverse in the future.

Example of a temporary difference between GAAP and tax amounts

Temporary differences between GAAP and tax amounts will reverse in the future. For example, consider an asset with a useful life of 10 years, no salvage value, and a cost of $100,000. A company uses bonus depreciation rules to claim $100,000 in tax depreciation during the property’s first year in service. For GAAP purposes, the company uses the straight-line method resulting in $10,000 of book depreciation. The $90,000 difference in depreciation expense – and basis – represents a temporary difference.

This results in zero difference between GAAP and tax income over the long term. GAAP pretax income initially exceeds taxable income by $90,000. Each year after, the company recognizes a $10,000 GAAP depreciation expense and $0 tax depreciation expense, reversing the temporary difference by $10,000. By the end of year 10, the asset has zero basis, and the company has recognized $100,000 of depreciation expense for both book and tax purposes.

Temporary differences create deferred tax assets or liabilities because their reversal affects future tax expense. Usually, this results in no net change to the ASC 740 provision for income tax – the change in the current tax provision offsets the change in the deferred tax provision. However, tax rate changes and valuation allowances can cause the total provision for income tax to change.

Reporting and disclosure requirements for ASC 740 compliance

The total ASC 740 provision for income tax goes on the income statement. Companies may choose whether to report current and deferred income tax expense on the income statement or as a separate disclosure.

ASC 740 requires the balance sheet to net all deferred tax assets and liabilities that can be offset for income tax purposes – usually meaning they relate to the same jurisdiction for the same entity. However, companies must disclose the total value of both deferred tax assets and liabilities.

Public companies must perform a tax rate reconciliation. They can reconcile either the expected tax – based on the statutory rate multiplied by GAAP pretax income – to the total income tax provision or the statutory rate to the effective tax rate (ETR).

Calculating effective tax rate

Companies calculate the ETR by dividing the total income tax provision by GAAP pretax income. Nonpublic companies must disclose significant effective tax rate reconciliation items but don’t need to provide a numerical reconciliation.

Additional disclosure requirements

Additional disclosures required under ASC 740 include:

- The net change in the total valuation allowance.

- Method of accounting for income taxes.

- Nature of temporary differences.

- Policy for classifying interest and penalties.

- Amounts and expiration dates of NOL and tax credit carryforwards.

The above list is not all-inclusive. Many other items can require additional disclosures under ASC 740.

How to create a consistent income tax provision process

The corporate income tax provision process can be complicated and has the potential for inaccuracies.

Public and private companies must submit quarterly and annual provisions for income tax. Not only are they among the most-scrutinized processes for most tax departments, but they also have the added complication of a short time frame for execution. This creates a host of inaccuracy risks and potential control failures. Therefore, data organization and understanding tax law implications are crucial for ensuring a smooth tax provision process.

Also essential to the process is understanding its flow so you can quickly and specifically address any issues that arise.

The following three-step checklist can help ensure a consistent tax provision process, including when evaluating uncertain tax positions.

Step 1: Determine the tax provision process flow

The tax provision process flow is affected by three distinct but related elements:

- Corporate facts – Legal structure, jurisdictions, general ledger, and other data that affect the tax provision process but exist independent of tax.

- Tax law – The body of law written by the tax authorities, including foreign tax credits, GILTI, and R&D credits.

- ASC 740 – Its own separate body of rules written by the Financial Accounting Standards Board (FASB). It interacts with the preceding elements but also has requirements separate from them.

Each piece is related but separate, and it’s important to be specific about where your pain points are occurring in the flow. For example, you might be experiencing a problem related to stock compensation, which could be due to several scenarios:

- Your general ledger information is incorrect. The data supporting the stock compensation deduction isn’t tied out or isn’t rolling forward.

- You’re making a mistake in applying tax law to your facts. Your reports are accurate, but your error is in calculating the book-to-tax differences.

- The data is sound, and you know how to calculate based on tax law, but you can’t get your tax provision to tie out the right way.

By differentiating which part of the flow is causing the issue, you’ll more quickly find the best way to address it. Below we’ll demonstrate how to follow the flow to create checklists for all areas of ASC 740.

Step 2: Maintain an uncertain tax positions checklist

One of the most important tasks related to uncertain tax positions is ensuring you have a consistent evaluation process. Use the flow outlined above to maintain a checklist of questions, narrowing from legal and company facts to ASC 740-specific info.

- Laws

a. Have the laws or regulations changed for this jurisdiction? - Business facts

a. Has my business changed in this jurisdiction?

b. Have I acquired business in this jurisdiction?

c. Have I changed my operating structure, or have I done new types of sales or new expansions? - Tax authority activity

a. Have income tax authorities opened or closed any exams?

b. Have any statutes expired?

c. Have there been any inquiries or notices not necessarily reaching the level of an exam? - Compliance

a. When I filed my income tax return, did I take a position contrary to what I had thought I would take on the provision? - Tax planning

a. Am I performing technical writing supported by tax law to document why I’m taking a particular position? If so, you may be dealing with a position that is not highly certain. That doesn’t mean it results in an uncertain tax benefit, but it probably reaches the level of going through the uncertain tax benefit analysis and evaluation.

You can use these questions as a filter to answer the question: “do I have an uncertain benefit item that I need to account for?”

Step 3: Analyze valuation allowance through the tax provision flow

Again, the ASC 740 valuation allowance (VA) process moves through the same flow – facts about the company/jurisdictions, to tax law, to ASC 740.

- Company facts – Does the company compute forecasts? Do we have historic and/or forecasted earnings?

- Tax law – Will we produce enough earnings to use tax credits, NOLs, or other tax elements?

- ASC 740 – If I apply the tax law, can I use the attribute or the deferred tax asset? This leads to the ASC 740 conclusion – I need a valuation allowance, or I don’t.

Problems with VA can occur in any of these three areas. For example:

- Are you experiencing difficulties because the forecasting team isn’t providing information by legal entity?

- Are you struggling with tax law calculations due to needing more technical knowledge?

- Do you already know you need a VA, and the challenge is managing the deferred roll-forward schedule?

Rather than simply acknowledging “We have a problem with VA,” evaluating through the lens of the tax provision flow will help streamline your problem-solving process.