KSL Daily and Weekly breakout 34% upmove possibleThis is price breakout stategy . you can use different timeframes as daily, weekly, monthly .

I scan stocks daily and try to find breakout structure after long consolidation and confirms with different timeframe and then draws some levels as price action then we make a perfect plan for entry, stoploss and target

If you like my ideas then support me .

Community ideas

krishna defence - next bull run is coming soonTrade Setup - KRISHNADEF (NSE)

Scenario: Bullish breakout from a rounding bottom pattern with a close above the 50% Fibonacci retracement level.

Entry:

Trigger: A candlestick close above ₹723 (the 50% Fibonacci level). This confirms a break above the rounding bottom pattern and suggests strong upward momentum.

Confirmation (Optional): You could wait for a second confirming candle close above ₹723 to further validate the breakout.

Stop Loss:

₹630.00 (as marked on the chart). This limits your risk by defining the point at which you'll exit the trade if the price moves against you.

Targets:

Target 1: ₹811 (38.2% Fibonacci retracement) - A common first target in this scenario.

Target 2: ₹919 (23.6% Fibonacci retracement) - A more ambitious target if momentum continues.

Target 3: ₹1,095.60 (as marked on the chart) - The most ambitious target, potentially based on previous resistance or a significant Fibonacci extension level.

Rationale:

Rounding Bottom: This pattern suggests a gradual shift in sentiment from bearish to bullish, with the potential for a significant upward move.

Fibonacci Confluence: The 50% retracement level is a key level in Fibonacci analysis. A break above it adds to the bullish case.

Stop Loss Placement: The stop loss below the recent swing low helps protect your capital if the breakout fails.

Trade Management:

Trailing Stop: Consider using a trailing stop loss to lock in profits as the price moves in your favor. You could trail your stop loss below the most recent swing low or use a moving average.

Partial Profits: You could take partial profits at each target level to reduce risk and secure some gains.

Important Considerations:

Timeframe: The timeframe of this chart is crucial. If it's a weekly chart, this setup implies a longer-term trade. A daily chart suggests a shorter-term trade.

Volume: Observe volume during the breakout. Increasing volume adds conviction to the move.

News and Events: Be aware of any news or events that could impact the stock price.

Risk Management: Only risk capital you can afford to lose. This trade setup, like any other, has no guaranteed outcome.

BAJAJ HEALTHCARE DOUBLE TOP MULTIYEAR BREAKOUTBAJAJ HEALTHCARE

Pattern: Multi-year breakout with a Double Top at All-Time High (ATH).

Volume: Significant increase in volume, confirming the breakout.

Entry Levels: Ideal entries at retracements of ₹500 and ₹475.

Stoploss: Maintain a strict stoploss below ₹430.

View: Positional trade; a potential long-term bullish opportunity based on technical strength.

( Disclaimer: This analysis is for informational purposes only and is not financial advice. Please trade at your own risk.)

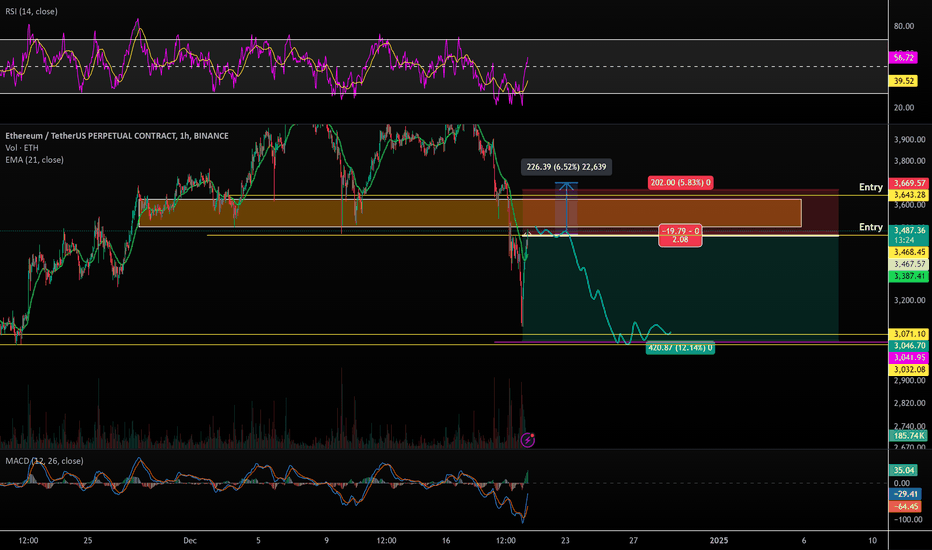

Short trade Ethereum.A trade idea based on my trading knowledge and market behavor.

I'm anticipation a retest on what what the double tiop previous support at 3480-3640 area.

Once we test it as resistance we will start a last wave downwards toward 3000-3100 area where I will anticipate we will start to go sideways untill the end of year.

Why do we need a new payment system?Ever wondered why no one seems to care when your money is stolen, your wallet is swiped, or your online banking gets hacked? That’s right. No one.

If there's one thing Satoshi Nakamoto and every other crypto pioneer probably despised, it’s this closed, rigged system where you only win if you’re already winning. In other words, today, having a bank account isn’t just necessary—it’s practically mandatory. But wait! No one will actually tell you that you have to open one. Not your bank, not the government, not even your employer. But here's the twist: the state will happily inform you that your taxes, fines, and any other payments—oh, and don’t forget those "bonuses"—can only be made via an Italian IBAN. No cards, no prepaid accounts. Or your employer will kindly let you know that your salary can only be paid into an Italian IBAN with your name on it.

Nobody tells you, “You must open a bank account in Italy,” but everyone acts like you can’t survive without it. And why is that? Because the bank is this monumental institution with centuries of history, reassuring you that your money is safe. Safe, sure. So safe, in fact, that it’s no longer yours.

Think about it. While you, the humble account holder, have to justify every move you make with your own money, the bank—once your deposit is in—takes it, uses it for its own operations, and invests it as it sees fit. And no, those aren’t just profits; they’re your funds, your deposits. In fact, they count as bank assets and are part of what’s known as the bank’s liquidity (or “CU” for those in the know). So, in case you missed the memo, your money is no longer just yours.

Here’s how the game works: the state mandates that anyone who participates in the economy must have a bank account, specifically with an Italian IBAN. You open your account and—voilà!—you can pay bills, receive your salary, and even contribute to the state’s coffers. Meanwhile, the bank is busy investing your liquid assets, generating dividends, and making a tidy profit.

But wait—since the bank is profiting off your money, the account must be free, right? Oh, come on. You didn’t really think they’d let that happen. The bank has to survive, after all. And those profits from millions in investments aren’t enough. Banks earn money not only through direct investments but also through every single transaction. Transfers? Oh, you’ll be charged anywhere from €0.50 to €2.00. Checking your statement? That’s another €0.60 to €1.70 per line. And don’t even get me started on account maintenance fees—typically anywhere from a few euros to €10 per month, depending on the bank, the balance, and the account holder’s age. So, yeah. You might end up paying an extra €3–4 on top of your €10 transfer, just to have the "privilege" of using your own money.

And that’s not all. Remember, the state’s also in on the action. Besides making sure employers can only pay wages into Italian bank accounts, they impose a stamp duty on accounts with an average balance over a certain threshold—say, €5,000. If you owe anything, the state can seize it directly from your bank account without your consent. And the government? They’ll take their cut, too. It’s a system, after all.

Let’s break it down a little more: the state provides a “safe” place to hold your money, but not without its own set of fees and taxes. The bank, that ever-reliable institution, justifies its costs with "security"—while quietly ignoring the fact that it's also using your money to make its own profits. And if you’re paying into a mortgage or loan, don’t be surprised if the bank takes your money directly if you default, without needing your permission. Oh, and the state? They’ll happily seize payments from your account if there’s any sign of liquidity issues. So much for personal security, right?

But what happens if you're the one who’s robbed? You’ve got insurance, sure—but no, they won’t pay out 100%. Why? Because of a maze of clauses that protect them, not you. The bank, despite charging you for account maintenance, is not the custodian of your money. They’re just another player in this cruel game. And if you try to report the theft to the authorities? You’ll go through hoops, paying fees for filing a report, only to be passed around between the insurance company and the bank, both of whom claim they’re not responsible. And the state? Well, they’ll just watch from the sidelines, as usual.

It’s a vicious cycle: you’re forced into this so-called "bank account" system. Your account becomes a tool to settle debts with both the bank and the state. Both entities have the right to withdraw from your account without prior consent or notification. Imagine that! The state can just grab money if there’s a liquidity problem—and the insurance, well, that’s just another expense with zero real benefit. But don’t worry—the bank is here to "protect" you. Once upon a time…

Today, however, banks only lend money if you already have it. Mortgages and leases? They’re available only to people who can buy the property outright. Insurance companies? They're shielded by state-backed protections, allowing them to easily shrug off responsibility. And for those lucky few who manage to get a loan, mortgage, or financing? Well, the bank will happily charge you interest on money you don’t have, while using your deposits to make more money for themselves.

So, yeah. The system is built to benefit everyone, except for you.

How do I know all these things ?

I work in a bank.

GICRE weekly breakout 74% upmove possible from entry level This is price breakout stategy . you can use different timeframes as daily, weekly, monthly .

I scan stocks daily and try to find breakout structure after long consolidation and confirms with different timeframe and then draws some levels as price action then we make a perfect plan for entry, stoploss and target

If you like my ideas then support me .

We are holding buy trade from 75950 , levels mentioned on chart Disclaimer -

This information is only for educational purposes, this is not for any buy or sell recommendations .

On Our Harmonic pattern indicator

based trade setup take trade as explained below :-

ENTRY -

When price breaks Trailing SL (SL 30 % )retracement Which is SL points then take Entry on Buy or Sell Trade

SL -

D points Which is recent High / Low mentioned in Chart is our SL

TARGET -

Target 1- (T1 : 50)

Target 2- (T2 : 61 %)

Target 3- (T3 : 78%)

Target 4- (T4 : 100%)

Please note:-

It's working on news based and volitile market very well so exit if SL hit

HDFC Bank Trade Setup on the Daily Chart📊 HDFC Bank Trade Setup on the Daily Chart 📈

Here's an interesting long trade setup for HDFC Bank:

🔹 Entry : 1771

🔹 Take Profit : 1881

🔹 Stop Loss : 1742

This trade aligns with a confluence of technical factors:

1️⃣ Fibonacci Retracement🟠: Price is bouncing near the 0.5 retracement level, signaling potential support.

2️⃣ EMA 50 🟡: Acting as dynamic support, strengthening the probability of a rebound.

3️⃣ Historical Resistance-Turned-Support 🟢: Price is testing a key zone previously broken.

Risk-to-reward ratio looks favorable for a swing trade. Keep an eye on how price reacts to this critical level.

💬 Share your thoughts in the comments!

"BE GREEDY WHEN OTHERS ARE FEARFUL.” Subject :

During this period, I view the market downturn as an opportunity to acquire quality stocks at lower valuations for long-term investment. As mentioned above, I am particularly interested in key levels for potential entry points. I wanted to share these insights with all of you, hoping you find them helpful. Thank you, everyone!🙏🏻

The recent downturn in both Indian and global stock markets can be attributed to several

key factors:

1. Monetary Policy Shifts: The U.S. Federal Reserve's recent decision to reduce the number of projected interest rate cuts for 2025 has heightened investor concerns.

2. Rising Treasury Yields: A significant selloff in long-dated U.S. government debt has pushed 10- and 30-year Treasury yields to their highest levels in nearly seven months. This trend poses a threat to stock valuations, as higher yields make risk-free government debt more attractive compared to equities.

3. Geopolitical Concerns: The potential return of Donald Trump to the U.S. presidency and his proposed economic policies, have raised fears of increased inflation and global trade tensions. These uncertainties contribute to market instability.

* Escalating conflicts in regions such as the Middle East have increased market volatility and investor uncertainty.

4. Foreign Investor Behavior: In India, heavy selling by foreign institutional investors has exerted downward pressure on markets. This trend is influenced by global monetary policies and a reduced appetite for risk amid prevailing uncertainties.

5. Sector-Specific Declines: Sectors such as financials and information technology have experienced notable losses, further dragging down market indices.

These combined factors have led to a bearish trend in both Indian and international stock markets in recent weeks.

About Reliance industries limited 📉:

1. Weak Performance in the Oil-to-Chemicals (O2C) Segment: RIL's O2C business, a significant revenue contributor, has faced challenges due to shrinking margins amid global oversupply. In the second quarter of FY25, the company reported a 5% decline in net profit, largely attributed to poor performance in its oil refining and petrochemical business. This segment was significantly impacted by cheap Russian crude oil flooding the market, pushing product margins lower.

2. Delays in IPOs of Jio and Retail.

3. Slowing Growth in the Retail Business: RIL's retail division has encountered slower growth, influenced by factors such as rising real estate costs and increased.

4. Broader Market Trends and Investor Behavior.

#valueinvesting. #indianstockmarket. #Reliance

Dabur India Stock at a Critical JunctureDabur India Ltd., a leading FMCG player, is showing an interesting technical setup on its weekly chart.

Key Highlights:

Strong Support: The stock has consistently respected a long-term ascending trendline since 2012.

Triangle Pattern: A descending triangle is forming, signaling potential breakout or breakdown.

Current Level: Trading at INR 507.50, near critical support at the trendline.

Outlook:

Bullish Case: A breakout above the triangle could target INR 680.

Bearish Case: A breakdown below INR 480 may signal further downside.

NIFTY Intraday Trade Setup For 23 Dec 2024NIFTY Intraday Trade Setup For 23 Dec 2024

Sell_1- From 23970

Invalid-Above 24020

T- 23700

Sell_2-Below 23530

Invalid-Above 23580

T- 23230

NIFTY has closed on a bold bearish note with 4.77% cut last week. Last weekend we discussed that index will be buy on dips till index is above 50 EMA in daily TF. On 17 Dec it closed below that. We will still maintain sell on rise approach till it is below 50 EMA and till it closes below previous day low in daily TF. If tomorrow's 10 o'clock range breaks in the upside then chance of rebound is there so keep an eye.

Coming to Monday's trade setup, if index opens flat and a 15 Min candle closes below 23530 then we will short for the target of 23230.

In case 23970 is tested then we will short from there. T- 23700.

In case of a big gap up/down, wait till 10 o'clock and mark the high and low of the trading range (5MIN). Trade on this range breakout.

==========

I am Not SEBI Registered

This is my personal analysis for my personal trading. Kindly consult your financial advisor before taking any actions based on this.

USD/JPY 15-Minute Chart AnalysisKey Observations:

1. Trendline Break:

- The price broke the ascending trendline, indicating a potential shift in momentum.

2. Support Zone:

- The price is hovering around a key support area (156.500–156.650). If this zone fails, we could see further downside movement.

3. Bearish Setup:

- A bearish view can be taken with the stop-loss around 156.900 to 156.940 and the target near 154.03.

- This gives a favorable risk-to-reward ratio if the setup plays out.

---

Trading Scenarios:

1. Bearish Continuation:

- If the price breaks below 156.500, it could confirm the bearish move towards 154.03.

- Watch for bearish momentum and volume to support the move.

2. Rejection and Reversal:

- If the support zone holds, the price might retest the resistance near 156.940 or higher, invalidating the bearish setup.

---

Patience is key here; wait for clear confirmation of the breakout or rejection.

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult a financial advisor before making investment decisions. Trade responsibly. Happy Trading

NYKAA 1HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

NYKAA Looking good for Downside..

When it break level 163.76 and sustain.. it will go Downside...

SELL @ 163.76

Target

1st 159.35

2nd 154.62

FNO

NYKAA DEC FUT – LOT 9 (Qty-26550)

NYKAA DEC 175 PE – LOT 7 (Qty-26550) – PRICE (7.90)

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert.

OPTION TRADING When you trade options, you're essentially placing a bet on if a stock will decrease, increase or remain the same in value; how much it will deviate from its current price; and in what time those changes will occur. Based on those parameters, you can choose to enter into a contract to buy or sell a company's stock.

You don't need a considerable sum of money to become an options trader. You can start small with a capital of less than Rs 2 lakhs too. However, as you start small, you need to be a careful trader so that you can cut down on the possibility of losses and enhance the return potential of your trades.

What is Option Chain ?Options chain can be defined as the listing of all option contracts. It comes with two different sections: call and put. A call option means a contract that gives you the right but does not give you the obligation to buy an underlying asset at a particular price and within the option's expiration date.

How does an option chain work? An option chain displays available call and put options for a specific underlying asset, with their strike prices, premiums, and open interest. It provides a snapshot of market sentiment and potential price movements.

#Nifty directions and levels for December 20th.Good morning, friends! 🌞

Here are the market directions and levels for December 20th.

Market Overview:

Both the global and local markets are maintaining a bearish sentiment. Today, the market may open with a slight gap-down start, as the Nifty is indicating a negative 80 points at 8:00 AM.

In the previous session, both Nifty and Bank Nifty experienced a minor pullback after the long gap-down. Although the structure remains bearish, we can expect a continuation only if it breaks the previous day's low with solid movement. If this happens, we can anticipate a target of 78% in the minor swing.

On the other hand, if the market initially pulls back without breaking yesterday's low, or if it finds support at the immediate support level with gradual movements, then we can expect a pullback of 23% to 38%. This is the basic structure. Otherwise, we can follow the same sentiment that we discussed in the previous session, as nothing has changed.

How to get profit by option chain in trading For long calls: If the underlying is above the strike price on expiration, the profit is the underlying price on expiry – strike price – premium paid per contract. If the underlying is at or below the strike price on expiration, the option has no value so your loss is the premium paid to buy the call option.

Options trading can be one of the most lucrative ways to trade in the financial markets. Traders only have to put up a relatively small amount of money to take advantage of the power of options to magnify their gains, allowing them to multiply their money many times, often in weeks or months.

BTCUSD 4 HR ANALYSIS | SHORT TRADE🚀 Bitcoin (BTC) Price Analysis - 4-Hour Timeframe 📊

Chart Overview:

Current Price: $96,935.44

Timeframe: 4-Hour chart

Date Published: December 20, 2024

Key Features:

Trend Channe l: The chart illustrates a red ascending channel that represents the previous upward trend in Bitcoin’s price.

Support and Resistance Levels:

Resistance Level : Identified at $99,612.38

Support Level : Identified at $89,438.39

Price Movement : Recently, there has been a significant price drop depicted on the chart.

Potential Drop: A green arrow indicates a potential price drop of 9.30%, equating to -$9,171.21.

Discussion Point : The chart poses the question, “Can Bitcoin drop 10% from next week (23 Dec 2024)? Comment what you think?

Analysis :

The ascending trend channel suggests that Bitcoin has been in an upward trend.

The recent price action shows a breach of this channel, hinting at a possible trend reversal.

Key support at $89,438.39 needs to be monitored, as a break below this level could confirm further downside.

The potential 9.30% drop indicates market uncertainty, potentially leading to a larger correction.

Conclusion: Monitor the key support and resistance levels closely. The breach of the ascending channel and the significant price drop could suggest a trend reversal, warranting caution for bullish positions. Stay tuned for updates as we approach the critical date of December 23, 2024.

Note - This is Only for education purpose.

Follow and give Like