KayVee Buy Sell Gold Indicator//@version=6

indicator(title="KayTest", overlay=true)

// Input Parameters

src = input(defval=close, title="Source")

per = input.int(defval=100, minval=1, title="Sampling Period")

mult = input.float(defval=3.0, minval=0.1, title="Range Multiplier")

// Smooth Range Function

smoothrng(x, t, m) =>

wper = t * 2 - 1

avrng = ta.ema(math.abs(x - x ), t)

smoothVal = ta.ema(avrng, wper) * m

smoothVal

// Compute Smooth Range

smrng = smoothrng(src, per, mult)

// Range Filter Function

rngfilt(x, r) =>

filtVal = x

filtVal := x > nz(filtVal ) ? (x - r < nz(filtVal ) ? nz(filtVal ) : x - r) : (x + r > nz(filtVal ) ? nz(filtVal ) : x + r)

filtVal

// Apply Filter

filt = rngfilt(src, smrng)

// Trend Detection

upward = 0.0

upward := filt > filt ? nz(upward ) + 1 : filt < filt ? 0 : nz(upward )

downward = 0.0

downward := filt < filt ? nz(downward ) + 1 : filt > filt ? 0 : nz(downward )

// Bands

hband = filt + smrng

lband = filt - smrng

// Colors

filtcolor = upward > 0 ? color.lime : downward > 0 ? color.red : color.orange

barcolor = src > filt and src > src and upward > 0 ? color.lime :

src > filt and src < src and upward > 0 ? color.green :

src < filt and src < src and downward > 0 ? color.red :

src < filt and src > src and downward > 0 ? color.maroon : color.orange

// Plot Indicators

plot(filt, color=filtcolor, linewidth=3, title="Range Filter")

plot(hband, color=color.new(color.aqua, 90), title="High Target")

plot(lband, color=color.new(color.fuchsia, 90), title="Low Target")

// Fill the areas between the bands and filter line

fill1 = plot(hband, color=color.new(color.aqua, 90), title="High Target")

fill2 = plot(filt, color=color.new(color.aqua, 90), title="Range Filter")

fill(fill1, fill2, color=color.new(color.aqua, 90), title="High Target Range")

fill3 = plot(lband, color=color.new(color.fuchsia, 90), title="Low Target")

fill4 = plot(filt, color=color.new(color.fuchsia, 90), title="Range Filter")

fill(fill3, fill4, color=color.new(color.fuchsia, 90), title="Low Target Range")

barcolor(barcolor)

// Buy and Sell Conditions (adjusting for correct line continuation)

longCond1 = (src > filt) and (src > src ) and (upward > 0)

longCond2 = (src > filt) and (src < src ) and (upward > 0)

longCond = longCond1 or longCond2

shortCond1 = (src < filt) and (src < src ) and (downward > 0)

shortCond2 = (src < filt) and (src > src ) and (downward > 0)

shortCond = shortCond1 or shortCond2

// Initialization of Condition

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni

// Long and Short Signals

longCondition = longCond and CondIni == -1

shortCondition = shortCond and CondIni == 1

// Plot Signals

plotshape(longCondition, title="Buy Signal", text="Buy", textcolor=color.white, style=shape.labelup, size=size.normal, location=location.belowbar, color=color.green)

plotshape(shortCondition, title="Sell Signal", text="Sell", textcolor=color.white, style=shape.labeldown, size=size.normal, location=location.abovebar, color=color.red)

// Alerts

alertcondition(longCondition, title="Buy Alert", message="BUY")

alertcondition(shortCondition, title="Sell Alert", message="SELL")

אינדיקטורים ואסטרטגיות

Uptrend Rainbow Song EMA ver.1 🎵Description for EMA Label & Cross Indicator (Pelangi Theme)

This indicator plots 4 EMA lines (200, 100, 50, and 20 periods) on the chart with dynamic labels that follow each EMA line. The labels update in real-time to reflect their relative position on the chart and provide useful insights based on market conditions.

🚩 Key Features:

Dynamic EMA Labels

The labels display the names of each EMA (e.g., "EMA 200") and will change text dynamically if the EMAs are in a specific bullish order:

EMA 20 (Blue): Displays "Di langit yang biru 🎵" (translated: "In the blue sky 🎵") if it's at the top.

EMA 50 (Green): Displays "Hijau" ("Green").

EMA 100 (Yellow): Displays "Kuning" ("Yellow").

EMA 200 (Red): Displays "Merah" ("Red").

Crossover Detection

The indicator detects and marks crossover and crossunder points between the EMA lines with colored circles:

Red Circle: EMA 200 crossing with EMA 100.

Yellow Circle: EMA 200 crossing with EMA 50.

Green Circle: EMA 200 crossing with EMA 20.

Blue Circle: EMA 100 crossing with EMA 50.

Purple & Orange Circles: Custom colors for other crossovers.

🎯 Usage:

This indicator helps traders identify EMA crossovers and track the relative position of EMAs in real-time. The dynamic labels make it easy to visualize when the market is in a bullish or bearish trend.

The label text changes based on the order of the EMAs:

If EMA 20 > EMA 50 > EMA 100 > EMA 200, it indicates a strong bullish trend, and the labels will change to a colorful theme.

🎨 Theme:

The indicator follows a "Pelangi" (Rainbow) theme, inspired by the song:

"Merah, Kuning, Hijau, di langit yang biru"

("Red, Yellow, Green, in the blue sky").

FuTech : MACD Crossovers Advanced Alert Lines=============================================================

Indicator : FuTech: MACD Crossovers Advanced Alert Lines

Overview:

The "FuTech: MACD Crossovers Advanced Alert Lines" indicator is designed to assist traders in identifying key technical patterns using the :-

1. MACD (Moving Average Convergence Divergence) and

2. Golden/Death Crossovers

By visualizing these indicators directly on the chart with advanced lines, it helps traders make more informed decisions on when to enter or exit trades.

=============================================================

Key Features of "FuTech: MACD Crossovers Advanced Alert Lines":

1. MACD Crossovers:

a) The MACD is one of the most widely used indicators for identifying momentum shifts and potential buy/sell signals. This indicator plots vertical lines on the chart whenever the MACD line crosses the signal line.

b) Upward Crossover (Bullish Signal) : When the MACD line crosses above the signal line, a green vertical line will appear, indicating a potential buying opportunity.

c) Downward Crossover (Bearish Signal) : When the MACD line crosses below the signal line, a red vertical line will appear, signaling a potential selling opportunity.

2. Golden Cross & Death Cross:

a) The Golden Cross occurs when the price moves above a long-term moving average (like the 50-day moving average), signaling a potential upward trend.

b) The Death Cross occurs when the price moves below a long-term moving average, signaling a potential downward trend.

c) These crossovers are displayed with customizable lines on the chart to easily spot when the market is shifting direction.

d) Golden Cross (Bullish Signal) : A blue vertical line appears when the price crosses above the selected long-term moving average.

e) Death Cross (Bearish Signal) : A purple vertical line appears when the price crosses below the selected long-term moving average.

=============================================================

Customization Options:

This indicator offers several customization options to suit your trading preferences:

1) MACD Settings:

a) Choose between different moving average types (EMA, SMA, or VWMA) for calculating the MACD.

b) Adjust the lengths of the fast, slow, and signal MACD periods.

c) Control the width and color of the vertical lines drawn on the chart for both up and down crossovers.

2) Golden Cross / Death Cross Settings:

a) Select the moving average type for the Golden Cross / Death Cross (EMA, SMA, or VWMA).

b) Define the lookback period for calculating the Golden Cross / Death Cross.

c) Customize the appearance of the Golden and Death Cross lines, including their width and color.

You can use both as well as either of the MACD lines or Golden Crossover / Death Crossover Lines respectively as per your trading strategies

=============================================================

How "FuTech: MACD Crossovers Advanced Alert Lines" indicator Works:

a) The indicator monitors the price and calculates the MACD and Golden/Death Crosses.

b) When the MACD line crosses above or below the signal line, or when the price crosses above or below the long-term moving average, it plots a vertical line on the chart.

c) These lines help traders quickly spot potential turning points in the market, providing clear signals to act upon.

=============================================================

Use Case:

a) Swing Traders: The indicator is useful for spotting momentum shifts and trend reversals, helping you time entries and exits for short- to medium-term trades.

b) Long-Term Traders: The Golden and Death Cross signals help identify major trend changes, giving insights into potential market shifts.

=============================================================

Why Use This "FuTech: MACD Crossovers Advanced Alert Lines" Indicator ?

a) Clear Visuals : The vertical lines provide clear and easy-to-spot signals for MACD crossovers and Golden/Death Crosses.

b) Customizable : Adjust settings for your personal trading strategy, whether you're focusing on short-term momentum or long-term trend shifts.

c) Supports Decision Making : With its advanced line plotting and customizable features, this indicator helps you make quicker and more informed trading decisions.

=============================================================

How to Use:

a) MACD Crossovers: Look for green lines to signal potential buying opportunities (when the MACD line crosses above the signal line) and red lines for selling opportunities (when the MACD line crosses below the signal line).

b) Golden Cross / Death Cross: Use the blue lines to confirm when a positive trend may begin (Golden Cross) and purple lines to warn when a negative trend may start (Death Cross).

=============================================================

Conclusion:

"FuTech: MACD Crossovers Advanced Alert Lines" indicator combines two powerful technical analysis tools, the MACD and Golden/Death Crosses, to provide clear, actionable signals on your chart.

By customizing the appearance of these signals and combining them with your trading strategy, you can enhance your decision-making process and improve your trading outcomes.

=============================================================

Thank you !

Jai Swaminarayan Dasna Das !

He Hari ! Bas Ek Tu Raji Tha !

=============================================================

Bullish Doji Star and TristarThis command will detect the Doji candlestick on your chart.

The purpose of this code is to automatically identify two popular bullish reversal patterns in price charts:

Bullish Doji Star: A candlestick pattern that can appear after a downtrend and signals a bullish reversal.

Bullish Tristar: A pattern formed by three consecutive doji candlesticks, indicating a potential trend change.

These patterns are used in technical analysis to identify potential trend reversal points.

This code is ideal for technical analysts and traders looking to identify trend reversals in the markets.

It is especially effective on daily or 4-hour charts.

Alerts:

Bullish Doji Confirmed: Sends an alert when the pattern is confirmed.

Bullish Doji Failed: Sends an alert to indicate that the pattern is invalid.

Turkish

Bu komut, grafiğinizdeki Doji mum çubuğunu tespit edecektir.

Kodun amacı, fiyat grafiklerinde iki popüler boğa dönüş formasyonunu otomatik olarak tanımlamaktır:

Bullish Doji Star (Boğa Doji Yıldızı): Düşüş trendinin ardından görülebilen ve yükseliş dönüşü sinyali veren bir mum çubuğu formasyonu.

Bullish Tristar (Boğa Üçlü Yıldız): Arka arkaya üç doji mum çubuğunun görüldüğü ve trend değişimini işaret eden bir formasyon.

Bu formasyonlar, potansiyel trend dönüş noktalarını belirlemek için teknik analizde kullanılır.

Kod, piyasalardaki trend dönüşlerini tespit etmek isteyen teknik analistler ve traderlar için idealdir.

Özellikle günlük veya 4 saatlik grafiklerde etkili sonuçlar verir.

Uyarılar (Alerts):

Bullish Doji Confirmed: Formasyon doğrulandığında bir alarm gönderir.

Bullish Doji Failed: Formasyonun geçersiz olduğunu belirten bir alarm gönderir.

Dual Spectrum RSI [CHE]Dual Spectrum RSI Indicator

Introduction

The Dual Spectrum RSI Indicator is an innovative and robust tool designed for traders aiming to enhance their market analysis and trading precision. This script leverages multi-timeframe analysis, advanced RSI configurations, and customizable visualization options to provide actionable insights for both trend-following and contrarian strategies.

Key Features

1. Dynamic Timeframe Selection

- Automatically adapts the resolution based on the current chart's timeframe.

- Options to switch between Auto Timeframe, Multiplier-based Timeframe, or Manual Resolution for complete control.

2. Advanced RSI Calculations

- Dual RSI setup for multi-layered analysis:

- Primary RSI for trend identification on the higher timeframe (HTF).

- Secondary RSI for entry signals with oversold/overbought crossovers on the current chart timeframe.

3. EMA Integration on Higher Timeframe (HTF)

- The Exponential Moving Average (EMA) acts as a robust trend filter, calculated on the Higher Timeframe (HTF).

- This ensures that trade signals align with the broader market trend, providing a strategic edge and reducing noise from lower timeframes.

4. Signal Clarity

- Visual labels for Buy and Sell signals directly on the chart.

- Dynamic stop-loss suggestions that adjust based on EMA crossovers and trend changes.

5. Customizable Visualization

- Gradient fills for overbought/oversold zones provide intuitive visual cues.

- User-friendly inputs for adjusting separator lines, color schemes, and label styles.

6. Comprehensive Data Display

- Real-time updates in an Info Box, showing active timeframe settings and resolution.

- Easy-to-understand trend conditions, making it accessible for both novice and professional traders.

Benefits for Traders

1. Precision in Decision-Making

The multi-timeframe capability ensures that traders always have the broader market context, minimizing false signals and enhancing trade accuracy.

2. Flexibility and Customization

Fully adjustable parameters allow traders to tailor the indicator to their unique trading style, whether scalping, day trading, or swing trading.

3. Enhanced Market Insights

By combining HTF trend filters, RSI dynamics, and EMA thresholds, this indicator provides a holistic view of market conditions.

4. User-Friendly Interface

The clean layout and intuitive options make it easy to integrate this tool into any TradingView setup.

5. Increased Confidence in Trades

With visual aids such as labels, gradients, and a trend-detection mechanism, traders can make decisions with greater confidence and less emotional bias.

Example Use Cases

1. Trend-Following Strategy

- Utilize the HTF EMA filter to confirm bullish or bearish trends.

- Enter trades when the secondary RSI crosses oversold/overbought levels in the direction of the trend.

2. Reversal Strategy

- Identify overextended trends using RSI crossovers.

- Look for counter-trend opportunities with precise stop-loss placements.

3. Scalping Setup

- Switch to intraday timeframes and use the multiplier-based resolution to capture short-term market movements.

How to Use

1. Add the script to your TradingView chart by pasting the provided Pine Script code into the Pine Editor.

2. Adjust the Timeframe Type, RSI parameters, and EMA length to align with your trading goals.

3. Monitor the generated signals and use them in conjunction with your broader trading strategy.

Disclaimer

The content provided, including all code and materials, is strictly for educational and informational purposes only. It is not intended as, and should not be interpreted as, financial advice, a recommendation to buy or sell any financial instrument, or an offer of any financial product or service. All strategies, tools, and examples discussed are provided for illustrative purposes to demonstrate coding techniques and the functionality of Pine Script within a trading context.

Any results from strategies or tools provided are hypothetical, and past performance is not indicative of future results. Trading and investing involve high risk, including the potential loss of principal, and may not be suitable for all individuals. Before making any trading decisions, please consult with a qualified financial professional to understand the risks involved.

By using this script, you acknowledge and agree that any trading decisions are made solely at your discretion and risk.

Conclusion

The Dual Spectrum RSI Indicator is not just another technical tool—it's a comprehensive trading companion that adapts to your needs, simplifies market analysis, and boosts your trading performance. Whether you're a beginner or a seasoned trader, this indicator provides the edge you need to succeed in today's dynamic markets.

Try It Today!

Experience the power of multi-timeframe analysis and take your trading to the next level. Add the Dual Spectrum RSI Indicator to your TradingView arsenal now!

Best regards

Chervolino

Trend following for Gold (Stoploss+Exit Criteria+P/L Display)This strategy is an upgrade on a TEMA gold trading strategy I have developed earlier. This strategy with it's unique moving averages features editable stoploss, as well as displaying P/L per closed trade on the chart.

Feel free to use and enjoy.

Happy hunting!

MAG 7 - Weighted Multi-Symbol Momentum + ExtrasOverview

This indicator aggregates the percentage change of multiple symbols into a single “weighted momentum” value. You can set individual weights to emphasize or de-emphasize particular stocks. The script plots two key items:

The default tickers in the script are:

AAPL (Apple)

AMZN (Amazon)

NVDA (NVIDIA)

MSFT (Microsoft)

GOOGL (Alphabet/Google)

TSLA (Tesla)

META (Meta Platforms/Facebook)

Raw Weighted Momentum (Histogram):

Each bar represents the combined (weighted) percentage change across your chosen symbols for that bar.

Bars are colored green if the momentum is above zero, or red if below zero.

Smoothed Momentum (Yellow Line):

An Exponential Moving Average (EMA) of the raw momentum for a smoother trend view.

Helps visualize when short-term momentum is accelerating or decelerating relative to its average.

Features

Symbol Inputs: Up to seven user-defined tickers, with weights for each symbol.

Smoothing Period: Set a custom lookback length to calculate the EMA (or switch to SMA in the code if you prefer).

Table Display: A built-in table in the top-right corner lists each symbol’s real-time percentage change, plus the total weighted momentum.

Alerts:

Configure alerts for when the weighted momentum crosses above or below user-defined thresholds.

Helps you catch major shifts in sentiment across multiple symbols.

How To Use

Select Symbols & Weights: In the indicator’s settings, specify the tickers you want to monitor and their corresponding weights. Weights default to 1 (equal weighting).

Watch the Bars vs. Zero:

Bars above zero mean a positive weighted momentum (the basket is collectively moving up).

Bars below zero mean negative weighted momentum (the basket is collectively under pressure).

Check the Yellow Line: The EMA of momentum.

If the bars consistently stay above the line, short-term momentum is stronger than its recent average.

If the bars dip below the line, momentum is weakening relative to its average.

Review the Table: Quick snapshot of each symbol’s daily percentage change plus the total basket momentum, all color-coded red or green.

Caution & Tips

This indicator measures rate of change, not absolute price levels. A rising momentum can still be part of a larger downtrend.

Always combine momentum readings with other technical and/or fundamental signals for confirmation.

For better reliability, experiment with different smoothing lengths to suit your trading style (shorter for scalping, longer for swing or positional approaches).

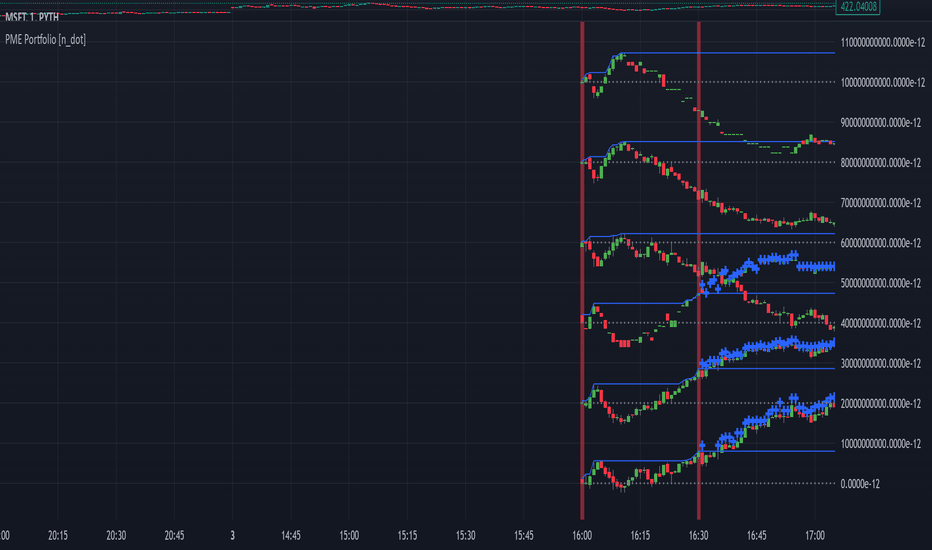

PreMarket_Estimator Portfolio [n_dot]AMEX:SOXL ; NASDAQ:TQQQ ; AMEX:FNGU ; AMEX:SOXS ; NASDAQ:SQQQ ; AMEX:FNGD

Strategy Core Idea:

I focus on stocks that are expected to show significant price movements (gaps) during the premarket, usually due to news or earnings reports. I record the highest price formed during the premarket, and if the price exceeds this level after the market opens, I go LONG. Based on my experience, it’s advisable to exit after a few percentage points of increase, as the premarket boom often corrects itself.

Usage:

The indicator is best used in pairs: Pre_Market_Estimator Single and Pre_Market_Estimator Portfolio.

In this portfolio version, you can set up 6 different instruments, which are displayed stacked vertically on the screen, while the single version monitors only one instrument. The portfolio does not plot charts at the actual price levels but offsets them vertically, displaying the current prices in a label at the end of each chart.

Settings:

Time point 1: Start of the observation period.

Time point 2: End of the observation period / Start of the trading period.

GAP: is used to adjust the distance between the charts displayed in the portfolio view. This allows you to customize the spacing for better readability and visualization of the monitored instruments.

Usage:

Set the timeframe period to "1m".

Set Time point 1 to the start of the premarket session on the current day (e.g., NYSE: 9:00).

Set Time point 2 to the market open (e.g., NYSE: 9:30).

The indicator monitors the highest price during the premarket period, marking it with a blue line.

During the subsequent trading period, if the price exceeds the premarket high, it generates a buy signal marked with a blue plus sign.

Limitations:

The premarket prediction typically provides actionable signals during the first 30 minutes to 1 hour of the trading session. After this, the trend is usually driven by daily market events or news.

To reduce data usage, the portfolio version of the indicator (which monitors 6 instruments simultaneously) only loads the last 24 hours of data (60 * 24 minutes). After this, the chart stops providing signals, and the time points need to be reset.

Additional Use Cases:

This type of breakout monitoring is not only suitable for observing premarket events but can also provide relevant information before major announcements.

For example, in the case of central bank rate hikes:

Set Point 1 to 1 hour before the announcement.

Set Point 2 to the time of the announcement.

I hope this contributes to your success!

Latuna Linear Regression Indicator V1The script uses Linear Regression for generating buy and sell signals:

Linear Regression Line: Plots the trend based on the closing prices.

Buy Arrow: Appears when the price crosses above the Linear Regression line.

Sell Arrow: Appears when the price crosses below the Linear Regression line.

Moving AverageThe Moving Average Indicator script on Trading View is a versatile tool designed to smooth price data and identify trends in financial markets. It calculates the average price over a specified period, helping traders visualize the direction of the market. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA), with adjustable periods to suit various strategies. By overlaying the indicator on the price chart, users can spot potential entry or exit points, trend reversals, and support or resistance levels. Ideal for both beginners and experienced traders, this script enhances decision-making with a clear, intuitive visualization of market trends.

Strong/Weak Single Levels//@version=5

indicator("Strong/Weak Single Levels", overlay=true)

// Input thresholds for strong and weak candles

strongCandleSize = input.float(1.5, title="Strong Candle Size (x ATR)")

weakCandleSize = input.float(0.5, title="Weak Candle Size (x ATR)")

// Calculate ATR for relative size comparison

atr = ta.atr(14)

// Identify strong and weak candles

isStrongGreen = (close - open) > strongCandleSize * atr

isWeakGreen = (close - open) > weakCandleSize * atr and (close - open) <= strongCandleSize * atr

isStrongRed = (open - close) > strongCandleSize * atr

// Check for strong and weak single levels

strongLevel = ta.valuewhen(isStrongGreen and isStrongRed , high , 0)

weakLevel = ta.valuewhen(isWeakGreen and isStrongRed , high , 0)

// Plot horizontal lines for levels

if strongLevel

line.new(x1=bar_index , y1=strongLevel, x2=bar_index, y2=strongLevel, color=color.green, width=2, extend=extend.right)

if weakLevel

line.new(x1=bar_index , y1=weakLevel, x2=bar_index, y2=weakLevel, color=color.red, width=2, extend=extend.right)

1% Drop from OpenTracks if price drops 1% from market open and marks it up with a call out on screen

thinkCNE - VolumeWorks the same as Relative volume - colour volume bars based on average volume.

i.e. if volume is 2x higher than the 10 day average, the volume bar is coloured blue.

Price Oscillator ClassicShows the classic version of the Price Oscillator in a histogram. This is a lagging indicator used to confirm trends

Supertrend with EMA - AjaySupertrend with EMA shows strength in Trend.

50 EMA is good for trend. and Supertrend with ATR give better stoploss.

Triple Confluence Strategy-nishant200 EMA: A yellow line showing the 200-period Exponential Moving Average.

VWAP: A blue line showing the Volume Weighted Average Price.

Pivot Points: A purple line for the pivot point, red lines for support levels, and green lines for resistance levels.

Buy/Sell Markers: Green labels below the bars for Buy signals and Red labels above the bars for Sell signals.

Confluence Zone Highlights: Background color changes to green for Buy and red for Sell signals.

BELIKENOOTHER34 SOPORTE Y RESISTENCIA FIBO Y PORCENTUALNos indica el soporte y la resistencia del timeframe seleccionado y nos da 3 lineas de fibonacci para detectar retrocesos y optimizar la entrada, las lineas de soporte y resistencia son del mismo color en función de si la vela cerro alcista respecto a la anterior o rojas si cerro bajista.

ATR neutral candlesATR with Limit. Avoid trades below ATR Limit.

It displays a trend based on the Average True Range (ATR), with candles colored yellow when the ATR is below a specified limit, and the ATR being customizable with different moving averages (RMA, EMA, SMA)

Dan-Machine Learning: Lorentzian Classification with AlertsAlerts by any colour change in smoothed Heikin Ashi candles.