All the features you need to finish payroll in minutes

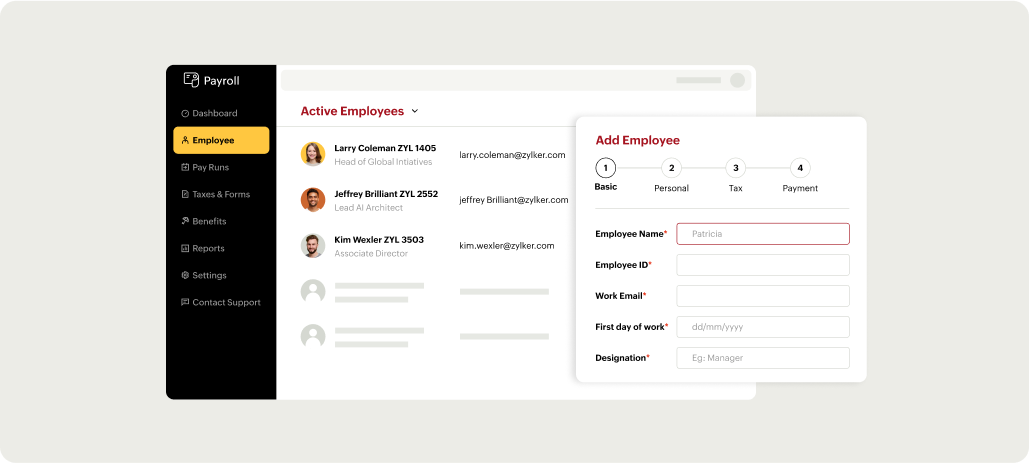

Complete payroll onboarding in four quick steps and spend more time getting to know your employees on their first day of work.

Build the team you need and pay them in every way—fixed or hourly wage—using one software.

Digitally collect W-4s through the self-service portal app and withhold the right tax amounts for each employee.

Let your employees access pay details, download pay stubs, and track time off and benefits wherever they are with a sleek self-service portal app.

Switch to Zoho Payroll at any time during the year without risking the loss of critical payroll information.

Get ready for pay days with a dashboard that offers an instant view of your upcoming payroll cycles, to-do tasks, and more.

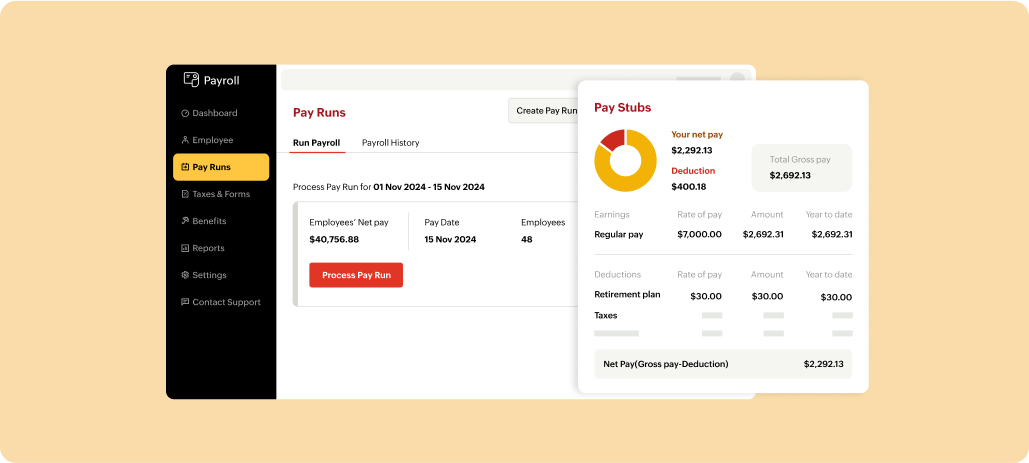

Choose a pay schedule that fits your business and meets employee expectations, whether weekly, bi-weekly, semi-monthly, monthly, or quarterly.

Simply enter the hours worked and let the software calculate your employees' precise gross-to-net pay down to the last digit.

Pay your teams faster and safer with direct deposits to employees' bank accounts, while retaining the convenience of printing paychecks when necessary.

Send professional looking pay stubs straight to your employees' inboxes or portals after every payroll and provide insights into their earnings, deductions, and taxes.

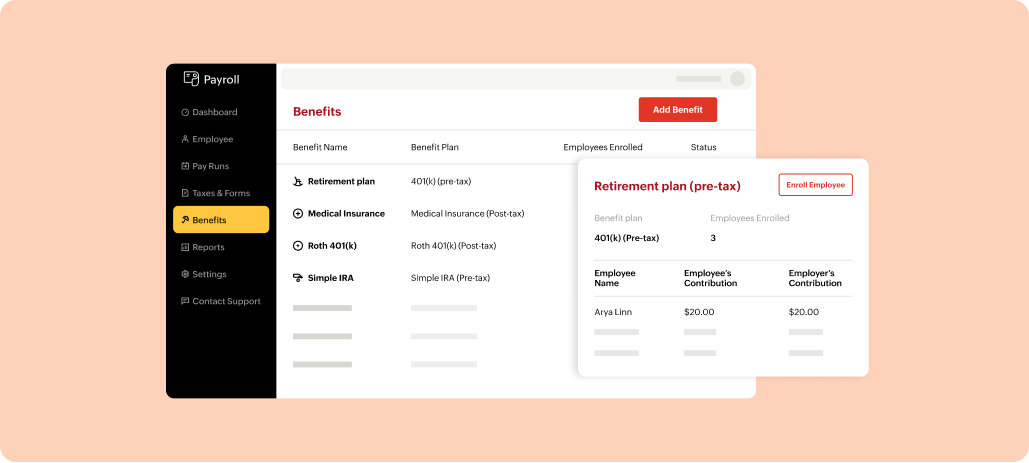

From health insurance to retirement plans, choose from over 16 ready-to-use benefits and enroll your employees right from day one.

Healthy employees build a healthy business. Offer comprehensive medical, dental, and vision insurance to support your teams.

Help your employees build a sizable retirement fund by providing tailored 401(k) plans and automating deductions each pay period.

Send your employees on a nice holiday or provide them the time they need to recover from illness with customized vacation and sick leave policies.

Reward your diligent employees for their disciplined attendance by paying out unused time off as a thank-you for their hard work.

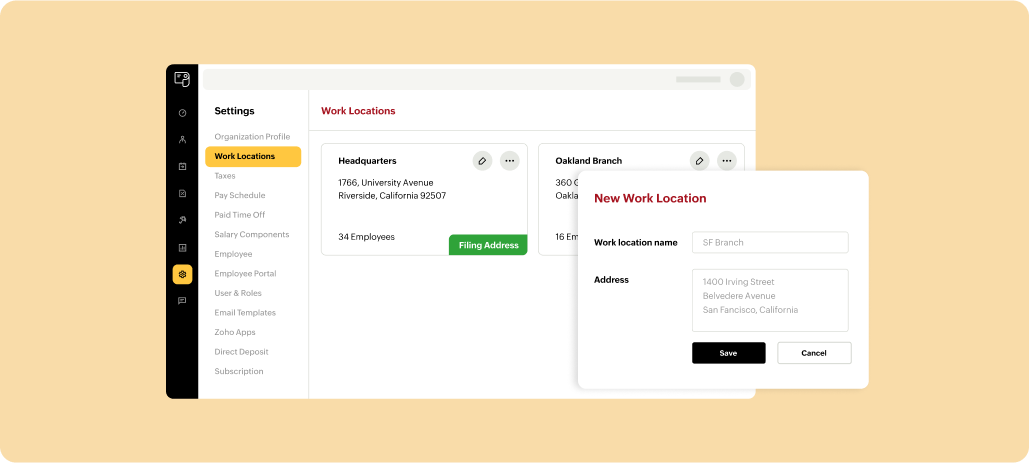

Create multiple work locations to manage your distributed teams and process payroll easily across all offices throughout the state.

Design and include custom earnings and deductions that suit each employee and your organizational hierarchy.

Add your accountant, HR department, or other team members to help you with payroll tasks, all while keeping control through fine-grained user permissions.

Don’t let minor hiccups affect your entire payroll. Easily skip individual employees during a pay run while ensuring the rest of your team is paid on time.

Monitor actions performed by your team and maintain a thorough record of all payroll changes.

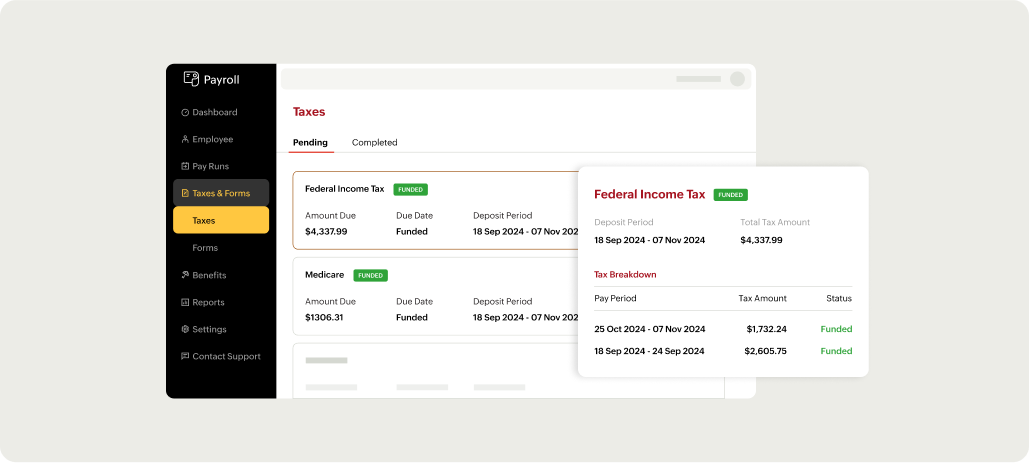

From local to state and federal, we ensure all your taxes are calculated, withheld, and paid on time, every time.

Learn moreAccurately calculate employee taxes by factoring in 401(k), FSA, and HSA contributions, and withhold the right amount of tax.

We track and apply every change in tax rates and payroll regulations, ensuring you stay compliant without needing any extra effort.

Digitally generate IRS-compliant forms 940, 941, and 944, along with state forms for easy tax reporting.

Send year-end W-2s directly to your employees via the self-service portal.

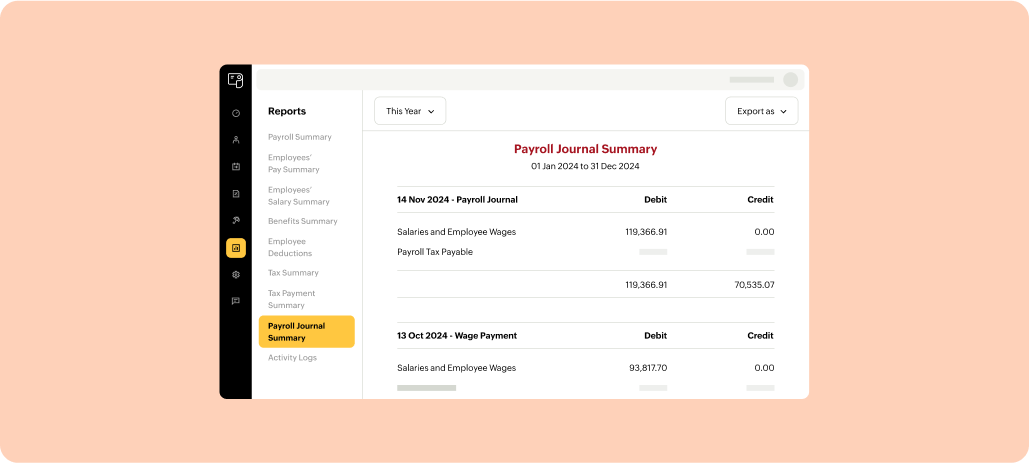

Get granular-level visibility into your payroll spend and unlock ways to optimize your business finances, like adjusting excessive benefit spending.

Understand every dollar spent on employees with pay and benefits summary reports and offer competitive pay to your well-deserving team.

Run your business on solid legal footing while effortlessly tracking all tax contributions with clear summary and payments reports.

Download reports in multiple formats—PDF, XLS, or CSV—and for the date ranges you need to analyze payroll with complete flexibility.

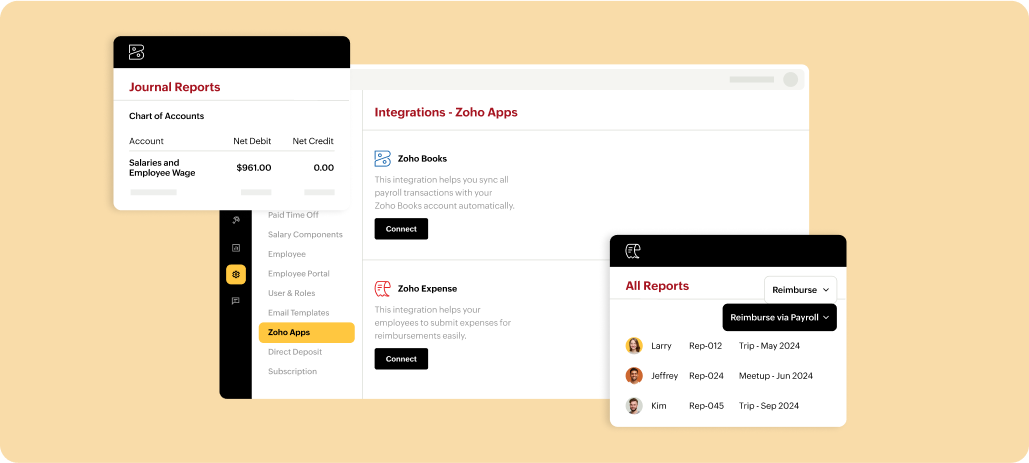

Integrate payroll with Zoho Books, our tax-compliant accounting software, to automatically post journal entries after each pay run.

Select liability accounts to track various payroll expenses and let reconciliation run on auto-pilot.

Lighten your workload by connecting Zoho Payroll with Zoho Expense and easily pay travel and expense reimbursements with every pay run.