XAUUSD Technical correction on the Channel Up started.Gold is trading inside a Channel Up for the entire month of January.

This pattern has so far given 4 corrections/bearish waves, all of which hit their 0.5 Fibonacci retracement level.

Given that the price got rejected today at the top of the pattern, we anticipate that the new technical correction has started.

Trading Plan:

1. Sell on the current market price.

Targets:

1. 2775 (on the 0.5 Fibonacci level, like all previous 4 corrections).

Tips:

1. The RSI (1h) already formed a Bearish Divergence, which confirms the sell signal.

Please like, follow and comment!!

Notes:

Past trading plan:

GC1! (Gold Futures)

The Market Matrix - Gold, Crude, DXY & Nasdaq for Feb 1 2025This weeks edition of The Market Matrix.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

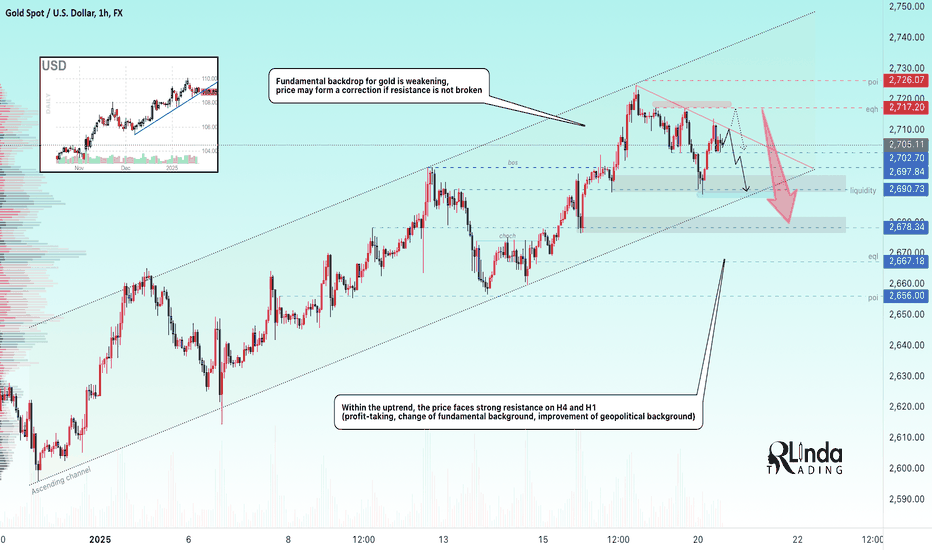

GOLD → Consolidation ahead of Fed rate meetingFX:XAUUSD is recovering ahead of Fed rates and Powell's speech. The price is consolidating as traders are not ready for premature action. What could happen?

Gold is holding near $2,770 in Asian trading in anticipation of Wednesday's Fed decision. Investors are cautious as the regulator may pause rate cuts and give hints on future policy. Markets expect two 25bp cuts this year, but Powell's rhetoric will determine the way forward.

Factors supporting gold: dollar correction, risk stabilization and holiday season in Asia. However, Trump's trade policy may increase inflation, forcing the Fed to keep high rates longer, which is negative for gold.

But! Further movement depends solely on Powell's rhetoric.

Resistance levels: 2765, 2771

Support levels: 2759, 2745

Technically, after breaking the bullish structure and updating the lows, the price is recovering in search of resistance and liquidity to continue the probable decline. But it depends on economic data. Possible false break of 2771 resistance before further decline.

Regards R. Linda!

XAUUSD: Channel Up intact and is targeting 3,000.Gold is bullish on its 1D technical outlook (RSI = 59.990, MACD = 28.040, ADX = 55.806) despite consolidating for the past 7 days. The reason is that the long term Channel Up is intact and in fact has started its new bullish wave by crossing over the HH trendline. This has already happened twice inside the pattern and in those instances, as long as the 1D MA50 remained intact, the rise reached the 2.618 Fibonacci extension. Our target this time is a little lower (TP = 3,000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAU: Gold's Supply Area: A Short Opportunity?As the market for gold fluctuates, there may be an opportunity to consider a speculative short position. Currently, gold appears to be retesting a supply zone, an area where selling pressure could drive prices lower. This retest may signal a shift in market sentiment, potentially leading to a retracement back to prior demand zones.

Technical Indicators: Observing price action and key technical indicators can reveal signs of weakness in gold's bullish momentum, supporting the case for a downward move.

Risk-Reward Ratio: Although taking an aggressive stance comes with risks, a well-placed stop-loss and clear profit targets can create a favorable risk-reward scenario.

Conclusion

Given these market dynamics, a speculative short position in gold, targeted at previous demand zones, could be worth considering. As always, it's essential to stay informed and manage risks effectively. What are your thoughts on this approach?

✅ Please share your thoughts about XAU in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GOLD → Character changes, bearish premise emergesGOLD updates the low and tests trend support, testing the market and traders' nerves. The dollar is rebounding, putting pressure on the metal.

Gold is moving into a correction, gradually changing the bullish nature of the market to bearish under selling pressure due to growing demand for the dollar amid fears of a trade war over Trump's policies.

The issue of tariffs by the US is still open. Meanwhile, traders' attention is focused on data on durable goods orders and consumer confidence in the US, as well as the Fed meeting, the outcome of which will be announced on Wednesday.

Technically, after breaking the bullish structure, the price is testing the channel support. It is quite difficult to break this line from the first time and the price may form a correction to 2745, or to the imbalance zone, for example, to 2750- 2760 Fibo, before the market desire to sell resumes.

Resistance levels: 2745, 2751, 2760

Support levels: 2735 (trigger), 2717

If 2745 does not miss price and gold returns to 2735, then we should prepare for a break of trend support. In that case, an impulse to 2717 could form.

But, if 2745 does not hold the price, gold may test 2750 - 2760 before falling further.

Regards R. Linda!

XAUUSD Major short-term Buy Signal just flashed!Gold (XAUUSD) has been trading within a Channel Up pattern since exactly the start of the year. This structure has held clear the 1H MA200 (orange trend-line) since January 06 and the most optimal buy entry of the last 3 times has been issued on the 1H MA100 (green trend-line).

This is the level that the metal touched today and is already rebounding past the 1H MA50 (blue trend-line). Along with the 1H RSI reaching its most efficient Support level (oversold barrier of 30.00) and rebounding, this is the strongest short-term buy signal.

Each such signal reached at least the 1.618 Fibonacci extension from the previous High. As a result, our short-term Target is 2810.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

How to Enter a BUY In GOLD This Week! Step By Step!This is how I do it every trading day, and I want to share it with my viewers!

Make sure your time frame alignment is one of the following:

Weekly - 4H - 15m - 1m

Daily - 1H - 5m - 1m

Then make sure your bias is aligned on each one of those TFs.

Then enter your trade on the 15m or 5 minute.

You're all set!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD → A correction before the final spurt to ATH - 2790 ?FX:XAUUSD has been shaking against the support at 2762 since the opening of the session. Most likely, the chances of ATH retest are still high. Dollar in correction gives chances to yellow metal lovers

Traders faced profit taking as they await Fed statements and the Trump administration's actions on trade tariffs. U.S. tariff plans and PMI data continue to influence sentiment, the dollar and gold. Economically, the week ahead will be quite important with Fed rate, US GDP and PCE decisions.

Technically, gold tested a key support zone, but the price did not reach the risk zone where we could expect a trend reversal. We can assume that the extra passengers were dropped off the train, taking their money ;)

Resistance levels: 2762, 2790

Support levels: 2751, 2747

The focus at this point is on the 2762 level. If the gold can consolidate above this support, then we should wait for 2790. Still, this is an important zone that cannot leave speculators alone. We are waiting for ATH retest and false breakout.

Regards R. Linda!

GOLD MARKET ANALYSIS AND COMMENTARY - [January 27 - January 31]Last week, the gold market continued to benefit from concerns related to tariffs and US President Donald Trump's statements on interest rates, along with a decrease in US bond yields and the USD, and gold prices traded. trading near a 3-week high of above 2,750 USD/ounce.

Ahead of the monetary policy meeting next week, it is predicted that the US Central Bank will keep interest rates unchanged and there will only be one interest rate cut this year, while Mr. Trump called on banks to Global central banks lower interest rates. This means there may be disagreements between Mr. Trump and the Fed. This is something that traders are paying attention to and gold prices are likely to benefit from its role as a safe haven asset.

This week's economic calendar will focus on central banks globally, with the US Federal Reserve and Bank of Canada announcing interest rate decisions on Wednesday, followed by an announcement from the European Central Bank. Europe on Thursday.

The market will also pay attention to some US economic data, including the December new home sales report released on Monday, durable goods and consumer confidence reports on Tuesday, GDP Fourth quarter weekly unemployment claims and pending home sales on Thursday, and PCE, personal income and personal spending on Friday morning.

📌Technically, on the H4 chart, this week's gold price has broken out of the Downtrend line and the important resistance level at 2725, gaining momentum to near the 2790 resistance threshold. Next week, if the 2790 resistance mark is broken, broken, gold prices will continue to set record high prices for early 2025.

Notable technical levels are listed below.

Support: 2,730USD

Resistance: 2,770 – 2,762 – (All-time high)

SELL XAUUSD PRICE 2831 - 2829⚡️

↠↠ Stoploss 2835

BUY XAUUSD PRICE 2712 - 2714⚡️

↠↠ Stoploss 2708

The Market Matrix - Gold, Crude, Nasdaq & DXY for Jan 26 2025This weeks edition of The Market Matrix.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

Weekly Market Forecast Jan 27 - 31stThis is an outlook for the week of Jan 27-31st.

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices are still moving higher, as investors are moving money from the USD to the equity markets, riding the Trump Pump. We'll see how long the euphoria will last, and how the market responds to a bevy of policy initiatives and executive orders by the US President.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD → Ahead of ATH. How can price react to resistance?FX:XAUUSD is updating its highs and is gradually approaching ATH. Before the last spurt consolidation or correction may be formed, but chances of reaching ATH are quite high.

Gold price continues its bull run amid uncertainty in Trump's trade policy and expectation of PMI data in the US. Market participants are seeking protection in gold due to global growth fears related to trade conflicts and rate policy. The hawkish stance of the Bank of Japan and dollar weakness also support the metal. However, a pullback is possible on Friday due to profit taking ahead of US GDP data and the Fed decision.

Technically, there is a strong resistance zone at 2790 - istric high ahead. A false break of the resistance may trigger a profit-taking and subsequent correction.

Resistance levels: 2790

Support levels: 2770, 2762, 2750

Before reaching the ATH, the price may form a retest of the support at 2762. But, the main focus is on the historical maximum. The chance of reaching the target is very high, but watch the price reaction to the resistance. False breakdown may provoke a deep correction.

Regards R. Linda!

XAUUSD Still a great multi year investment. Why it can reach $40Gold / XAUUSD recovered the November-December 2024 correction and resumed the long term bullish trend.

On this 1W chart, it is evident that the yellow metal is incredibly bullish after crossing over the top of the multi year Cup pattern in March 2024.

This Cup started on the 2011 High (All Time High then) and was practically the Bear Cycle after the golden multi year rally that followed Gold's ETF lauch in the early 2000s.

Right now we have started Gold's new Bull Cycle and with the 1week MA50 supporting, we expect another 5 years of growth.

Gold remains a sound long term investment, especially in a highly inflationary environment.

If you are a long term investor, buy and hold until $4000.

Follow us, like the idea and leave a comment below!!

GOLD → The bulls are fighting for 2750. ATH is close!FX:XAUUSD is in a bull run phase due to rising risks. The price is testing new highs and trying to consolidate above key resistance. Trump's speech is ahead and high volatility should be expected.

Gold price is consolidating in the bullish zone after breaking through the three-top resistance. Traders are analyzing the impact of President Trump's tariff policies, which have caused uncertainty in the markets and weakened demand for the dollar and bonds. Meanwhile, support for gold prices is provided by optimism from China's measures to stimulate stock markets.

Investors' attention is focused on US economic data, including weekly jobless claims and Friday's PMI from S&P Global, which could affect expectations for a Fed rate cut. Weak statistics will reinforce forecasts of two rate cuts this year, which supports interest in gold.

Technically, the focus is on 2750. If bulls hold their defenses above this zone, gold could head towards ATH.

Resistance levels: 2750, 2762

Support levels: 0.5 fibo, 2732

Bullish trend, high risks, politics. Lots of reasons that support the metal. But, today is Trump's speech, and this man knows how to make noise in the market. High volatility is possible. But, in general, gold looks as if it is ready to go up, perhaps it can even renew ATH

Regards R. Linda!

GOLD heads for all-time record levelsOANDA:XAUUSD held steady near record highs on Thursday (Jan. 23) as investors awaited further guidance from the new Trump administration on trade policies and potential tax cuts.

Gold prices remain near their highest levels since last October as investors consider the impact that President Trump's latest tariff threats against China and the European Union could have on with the global economy.

OANDA:XAUUSD currently trading at nearly $2,752, $40 below its all-time high and up about 2% in the week to date.

Gold was supported by safe-haven demand as investors weighed the new administration's stance on trade. US President Donald Trump has named China, the European Union, Canada and Mexico as potential import tariff targets, although there remains uncertainty about whether he will do so.

Trump said he is considering imposing a 10% tariff on goods imported from China starting February 1. He also promised to impose tariffs on imports from Europe but did not provide further details.

He had previously said that Mexico and Canada could face tariffs of around 25% on February 1.

The Federal Reserve will meet next week as economic growth continues and inflation declines but faces uncertainty from the new administration's policies. The central bank is expected to leave the key interest rate unchanged at its next policy meeting on January 28-29. High interest rates reduce the appeal of non-interest-bearing gold, but with the current market context, the Fed keeping interest rates unchanged is not a potential pressure for gold to adjust significantly.

European Central Bank policymakers unanimously backed further interest rate cuts on Wednesday, signaling that a rate cut next week is almost a foregone conclusion. will be implemented even as the Federal Reserve remains cautious.

Analysis of technical prospects for OANDA:XAUUSD

On the daily chart, gold corrected very slightly but now it has all the conditions for expectations to reach an all-time high.

The main uptrend is reinforced by the break above the green price channel combined with price activity above the $2,750 level noticed by readers in yesterday's edition, along with that the Strength Index Relative RSI also shows that there is still room for price growth ahead.

Currently, the upside momentum is being blocked by the $2,762 technical level and once this level is broken gold could continue to rise with a subsequent target at the all-time high of $2,790.

As long as gold remains above the EMA21, and above the green price channel, it remains bullish in the short to medium term and notable levels are listed below.

Support: 2,750 – 2,730 – 2,725USD

Resistance: 2,762 – 2,790USD

SELL XAUUSD PRICE 2776 - 2774⚡️

↠↠ Stoploss 2780

→Take Profit 1 2769

↨

→Take Profit 2 2764

BUY XAUUSD PRICE 2720 - 2722⚡️

↠↠ Stoploss 2716

→Take Profit 1 2727

↨

→Take Profit 2 2732

Approaching 2,750 USD, the prospect of a new bull cycleInfluenced by Trump's tariff threats, investors flocked to the safe-haven asset gold. Gold prices soared to their highest level in more than two months. As of the time of writing, spot gold was trading at 2,749 USD/oz, an increase equivalent to 0.17% on the day and close to the target level of 2,750 USD.

US President Trump said he is considering imposing 25% tariffs on Mexico and Canada: "I think we will do this on February 1."

According to Reuters, Trump confirmed that general tariffs on all US imports are also being considered and will be implemented at a later stage. During Trump's election campaign, he proposed a "comprehensive tariff" of 10% to 20% on all imported goods.

Trump also threatened to impose tariffs on the continent soon, saying he would "resolve the deficit with the EU by imposing tariffs or asking the EU to buy our oil and gas".

Trump's sweeping trade tariffs are expected to spur further inflation and spark a trade war, which could increase gold's safe-haven appeal.

Looking back at history in 2017, the first year of Trump's final term in the White House, gold prices rose 13%, marking the best year in seven years.

In addition, the US Dollar index fell sharply from its peak on Tuesday and only recovered slightly at the beginning of today's Asian trading session Wednesday, January 22 which is also considered a favorable condition for prices. Yellow.

In the Middle East, the ceasefire agreement between Israel and Hamas stalled when Israeli forces began operations in the West Bank city of Jenin. In response, Hamas called for an escalation of fighting against Israel.

Gold is considered a safe investment in times of economic and geopolitical instability, and this Middle East factor is also seen as a supportive factor for gold prices in the current context.

Analysis of technical prospects for OANDA:XAUUSD

On the daily chart, gold achieved a target gain at $2,730 then broke out and approached the next target loss at $2,750.

In the short term, if gold continues to break above $2,750 it is likely to continue its uptrend with a target that could be an all-time high.

In terms of conditions, gold still has the main prospect of rising prices with the green price channel as the main trend, main support from EMA21 and the Relative Strength Index RSI showing that there is still wide room for growth in the market. front.

During the day, as long as gold remains above the green price channel, it remains bullish with expectations for a new bull run once $2,750 is broken and notable levels will be listed again as follows.

Support: 2,730 – 2,725USD

Resistance: 2,750 – 2,790USD

SELL XAUUSD PRICE 2773 - 2771⚡️

↠↠ Stoploss 2777

→Take Profit 1 2766

↨

→Take Profit 2 2761

BUY XAUUSD PRICE 2708 - 2710⚡️

↠↠ Stoploss 2704

→Take Profit 1 2715

↨

→Take Profit 2 2720

XAUUSD: Channel Up in need of a pullback.Gold is on an excellent bullish 1D technical outlook (RSI = 65.521, MACD = 20.810, ADX = 45.124) that highlights the uptrend provided by the Channel Up pattern since the start of the year. Having the 4H MA50 as the first support level, every time the price hit the pattern's top for a HH, it pulled back for 3 days to the 0.5 Fibonacci retracement level. Consequently, our aim is that level (TP = 2,720) but we will take profit earlier if the 4H RSI hits its HL trendline first.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD → A very strong uptrend may get its continuationFX:XAUUSD is rising due to high geopolitical and political risks. A strong bullish trend is forming, within which the price tests the strong resistance 2726 and draws a false break of the resistance...

The rise is shaping up more on the back of Trump's threats on tariffs, adding to the risk-negative sentiment in the markets. Trump has proposed imposing tariffs on Mexico and Canada, as well as the EU and China, if a trade agreement is not reached. These threats are supporting demand for gold as a safe-haven asset. However, the strengthening dollar and expectations of Fed rate cuts are limiting further upside for gold. Trading in the coming days will depend on the general market atmosphere and Trump's tariff discussions.

Technically, a false break of such a strong resistance could temporarily slow the growth and move the price into correction or consolidation, but there are nuances of technical...

Resistance levels: 2721, 2726, 2761

Support levels: 2703, 2697, 2690

At the moment it is worth paying attention to 0.5 fibo (2717) and 0.7-0.79 fibo. These are quite strong and important liquidity zones that can stop the correction and bring gold back to the uptrend. A retest of the local high of 2726 - 2732 will hint at the readiness of the metal to go even higher.

Regards R. Linda!

GOLD skyrocketed, Trump's influence provided strong supportIn the Asian market today, Tuesday, January 21, influenced by Trump's tariff comments that stimulated risk aversion, OANDA:XAUUSD suddenly jumped to 17 USD in the short term and are currently approaching the mark of 2,725 USD/ounce.

Trump was sworn in as the 47th President of the United States in the Oval Office of the Capitol.

US President Trump recently announced that he plans to impose tariffs on Mexico and Canada no later than February 1, possibly up to 25%, and reiterated his view that the two neighboring countries America's neighbors are allowing illegal immigration and drugs into the United States.

Complaining about fentanyl and migrants crossing the northern U.S. border, Trump called Canada a “very bad abuser” and said the target date for tariffs would be “I think February 1st. "

Trump made the remarks shortly after returning to the Oval Office to sign a series of executive orders. The executive orders cover everything from regulation to energy to immigration.

This is an early sign that Trump has increasingly focused on trade since taking office. These comments have stimulated risk aversion in the market to increase rapidly. Not only did gold strengthen, but the safe-haven Dollar also increased strongly. Impacting the market, we can see that recently both gold and Dollar, which have a negative correlation, have increased in price together.

Trump's sweeping trade tariffs are expected to spur further inflation and spark a trade war, which could increase gold's safe-haven appeal.

Analysis of technical prospects for OANDA:XAUUSD

On the daily chart, gold has approached the $2,725 level that was the initial upside target noticed by readers in the previous issue, followed by the $2,730 price point of the 0.236% Fibonacci retracement.

Technically, gold still has all the conditions for price increases with the trend being noticed by the green price channel, main support from EMA21 and the nearest support is the 0.382% Fibonacci retracement level.

Meanwhile, the uptrend of the Relative Strength Index also creates an uptrend and is still quite far from the overbought level, showing that there is still wide room for price growth ahead.

Moving forward, the technical outlook for gold remains bullish and notable levels are listed below.

Support: 2,700 – 2,693USD

Resistance: 2,725 – 2,730 – 2,750USD

SELL XAUUSD PRICE 2746 - 2744⚡️

↠↠ Stoploss 2750

→Take Profit 1 2739

↨

→Take Profit 2 2734

BUY XAUUSD PRICE 2684 - 2686⚡️

↠↠ Stoploss 2680

→Take Profit 1 2691

↨

→Take Profit 2 2696

The Direction of Gold 25.01.20Hello, this is Greedy All-Day.

Today’s analysis focuses on gold.

Gold Daily Chart Analysis

Chart:

Key Observations:

Gold recently broke above its long-term descending resistance trendline.

The resistance trendline began at the high on October 31, 2024, and was broken on January 16, 2025.

After breaking the resistance, gold reached a high near 2761, which failed to break above the top of the orange supply zone.

The current resistance stands at 2759.2, below the orange zone's high of 2761.3, leading to a short-term pullback.

Support Test and Outlook:

The yellow resistance trendline has turned into support after a successful retest.

Although the orange box supply zone has not been broken, the overall bullish momentum remains intact.

Next Resistance Levels:

If 2761.3 is broken, the next resistance lies at 2772.6, the upper wick resistance level within the purple box.

Breaking above 2772.6 could open the door for a potential retest of the all-time high near 2801.8.

Long-Term Trendline and Supply Zones

Chart:

Downside Risk:

A potential short-term trend reversal requires the green box to be broken.

Current key support for a breakdown: 2666 (below this level, gold will likely fall out of the Ichimoku Cloud).

A break below the red box supply zone’s lower boundary (2595) could signal a bearish shift in the larger pennant structure.

Current Gold Levels and Trading Strategies

Chart:

Buy Strategy:

A breakout above 2761.3 is crucial for initiating a long position.

If broken, the next target is the 2772 resistance level, with further potential upside to all-time highs if 2772 is cleared.

Sell Strategy:

Focus on the range between 2729.2–2720.9 for sell signals.

For gold to return to bearish momentum, the current support trendline (yellow) must break and turn back into resistance.

If the price breaks below 2729.2–2720.9, the next support level is the red ascending trendline.

Summary

Bullish Scenario: A breakout above 2761.3 could signal continuation toward 2772.6 and beyond.

Bearish Scenario: A break below 2729.2–2720.9 could lead to a deeper correction toward the red ascending trendline or lower levels.

Stay strategic and monitor key levels carefully for potential opportunities. 🚀

XAUUSD One Resistance remains before it marches to $3000.Last week's call on Gold (XAUUSD) gave us an excellent pull-back buy entry on the 4H MA50 (blue trend-line) and reached not only the top of the Channel Up but almost Resistance 1 as well:

Reaching Resistance 1 has always been a strong bullish signal for the long-term Channel Up that started more than 1 year ago on the October 06 2023 Low. As you can see, both two times that the price broke above the Triangle pattern of its Bearish Leg and tested Resistance 1, it eventually broke it, confirming the new Bullish Leg.

All three break-out Legs have 1D MACD Bullish Crosses to show for. With both previous Bullish Legs peaking upon at least a +21.85% rally, we expect Gold to hit $3000 minimum by April.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD → A change in fundamental background. Strong resistanceFX:XAUUSD faces strong resistance at 2721 and enters correction phase, which also coincides with the change of fundamental background and economic data

Weakening geopolitical tensions in the Middle East have reduced demand for safe-haven assets such as gold, the US dollar and US bonds. In addition, expectations of stimulus measures from China improved market sentiment.

Despite this, the downward trend for gold may remain limited due to Trump's rather risky policies and expectations of two Fed interest rate cuts later this year. Overall, gold prices are likely to be volatile in the short term due to holiday market conditions and Trump's upcoming executive orders.

Technically, the price is inside a symmetrical triangle, which in turn is located inside an ascending channel. If the resistance is not broken, pressure will be applied to the support....

Resistance levels: 2713, 2717, 2721

Support levels: 2702, 2697, 2690

A retest of 2702 will increase the chances of support breakdown and further fall. It can happen after the resistance retest. I do not exclude a false breakdown of one of the mentioned resistance levels before a further fall.

Regards R. Linda!