Straightforward

No jargon, no waffle, we make pensions simple.

See our approachesGood value

Our experts invest your money worldwide to reduce risk and help it grow, at a fair price.

Learn about our chargesResponsible

We make investment decisions that consider people and the planet.

See how we invest responsiblyRewarding

Treat yourself with rewards from the Virgin family and beyond.

Get rewarded

Four approaches to choose from

It’s easy to decide which investment approach is right for you. Our handy Investment Mix and straightforward descriptions will help you choose.

Learn about our Investment MixCareful Defensive approach

To minimise and defend against ups and downs.

Cautious Growth approach

A slower, cautious approach to growing your money.

Balanced Growth approach

For higher growth potential, but more ups and downs than with our Cautious Growth approach.

Adventurous Growth approach

For higher growth potential, but more ups and downs than with our Balanced Growth approach.

See how much your money could grow

Use our quick and easy calculator to see how bright your financial future could be

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

Investment Mix

Close Modal- Higher potential returns and risk

- Lower potential returns and risk

The Investment Mix shows you how much of your money typically goes into higher risk investments with higher potential returns, and how much goes into lower risk investments with lower potential returns.

For more info, check out our guide.

Investing your pension and the risks

Learn about pensions

Find out everything you need to know about pensions with handy tips, guides and videos from our pensions experts.

Check it outWant someone else to drive?

Switch to our steered-for-you Navigator pension. It’s like sat nav for your retirement journey.

Explore Navigator

The serious bits

- Charges

- Our charges are up to 0.75% in total each year, based on the value of your account. This is made up of two clear and simple charges. An Account Charge of 0.30% for managing your account and an Annual Management Charge of up to 0.45% for managing your investments.

More about our charges - Our Terms

- Everything you need to know, explained clearly. Includes the Key Features of the Pension and how we use your personal information.

Terms Link opens in a new window Our funds and charges Link opens in a new window - Security

- We help keep you safe online with our extra level of protection.

More about security - Protecting your money

- In the unlikely event we can’t meet our financial obligations, you may be entitled to compensation from the Financial Service Compensation Scheme (FSCS) up to a maximum value of £85,000.

Find out about the FSCS - Fund Value Assessment report

- An evaluation of our funds' value for money and performance. Its purpose is to report on whether we believe we are providing good value. It also outlines our plans if there are things we think we can improve.

Find out about the Fund Value Assessment report

A quick check

Before you get stuck in just make sure you can tick off this list:

- You're a UK resident

- You're aged 18 years or over

- You’re happy making your own investment decisions

Apply for Self-Drive pension

If you know enough about Self-drive and just want to get going, select an option

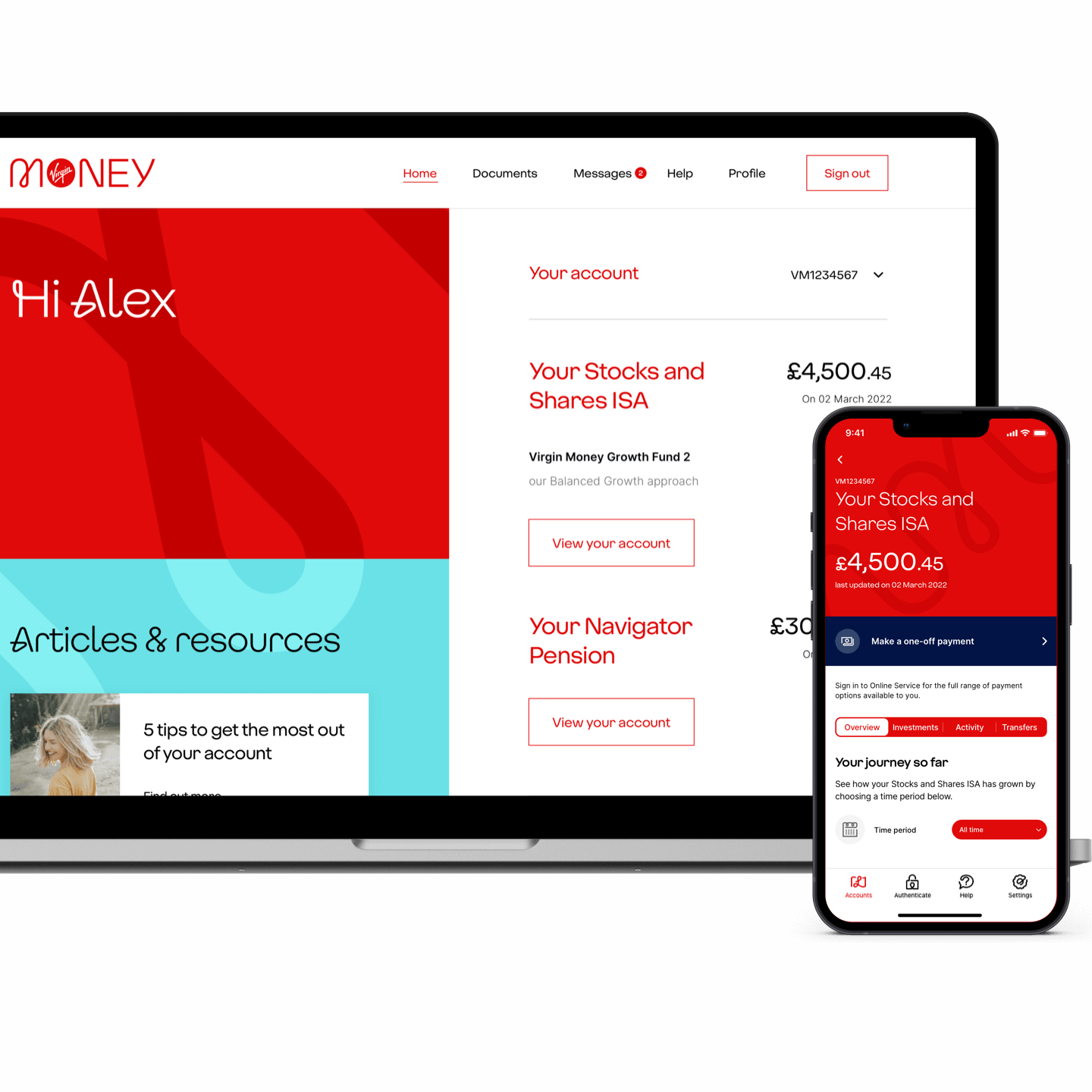

Stay in control with our Online Service and app

Making it easy to keep track of your investments and pension wherever you are.

Explore Online Service