Option Chain in Trading What is Implied Volatility (IV)? Implied Volatility (IV) uses an option price to determine and calculate what the current market is talking about, the future volatility of the option's underlying stock. Implied volatility is one of the six essential factors used in options pricing models

The Nifty Option Chain provides a listing of all the available options contracts for the Nifty 50 Index; including the strike prices, expiry dates, and the corresponding premiums. The list shows all call and put options that are available against a specific underlying

The most successful options strategy is one that has the highest probability of profit, taking into consideration the trader's market outlook. In a bull market, selling puts can be a profitable strategy due to the statistical edge of most puts expiring worthless

Support

Nifty 50 - Portfolio Colour similar to color of Christmas?Year endings have historically been famous for a big correction and 2024 is no different.

As I had mentioned in my previous idea, 23900, 23300 are crucial support to Nifty and 24300, 24800 are strong resistances

We had seen a good bounce from 23300 to 24780 and then a good fall once 24300 was broken again.

23200-23300 will be a key level to understand next trend for Nifty.

As we can see, there is a confluence of trendlines and demand zone around 23200.

If we see a bear trap forming at this zone, one can expect 25000+ levels in January 2025.

But if 23200 is broken, bloodbath may continue till budget with next key support zones being 22700, 22000, 21500.

Market is going to be volatile as we are going to see a change in lot size of Nifty 50 from new year.

It is better to be sector specific for swing trading.

HDFCBANK Support & Resistance HDFC Bank has a hierarchical organizational structure that categorizes employees into different levels based on their roles, responsibilities, and experience. These levels typically include the following:

1. Entry-Level

Roles: Customer Service Executive, Sales Officer, Relationship Officer, Teller.

Focus: Frontline banking operations, customer service, and sales.

Typical Qualifications: Graduates or MBAs with 0-2 years of experience.

2. Junior Management

Roles: Assistant Manager, Deputy Manager.

Focus: Supervising teams, basic managerial responsibilities, and operational oversight.

Growth Path: From entry-level positions through internal promotions or external hiring.

3. Middle Management

Roles: Manager, Senior Manager, Branch Manager.

Focus: Leading teams, managing branch operations, and achieving business targets.

Responsibilities: Overseeing customer relationships, ensuring compliance, and mentoring junior staff.

4. Senior Management

Roles: Regional Manager, Cluster Head, Zonal Head.

Focus: Overseeing multiple branches or regions, strategic planning, and business development.

Responsibilities: Driving profitability, high-level decision-making, and coordination between departments.

5. Executive Management

Roles: Country Head, Group Head, Executive Vice President.

Focus: Shaping the overall business strategy, governance, and leadership.

Responsibilities: Company-wide decision-making and aligning operational goals with the bank's vision.

6. Top Leadership

Roles: Managing Director (MD), Chief Executive Officer (CEO).

Focus: Overall governance, steering the organization, and stakeholder management.

Responsibilities: Accountability to shareholders, regulatory bodies, and aligning the organization with market trends.

HDFC Bank also promotes a culture of internal growth and provides numerous training and leadership programs for career advancement. The exact titles and levels may vary slightly based on the department, such as retail banking, corporate banking, IT, or risk management.

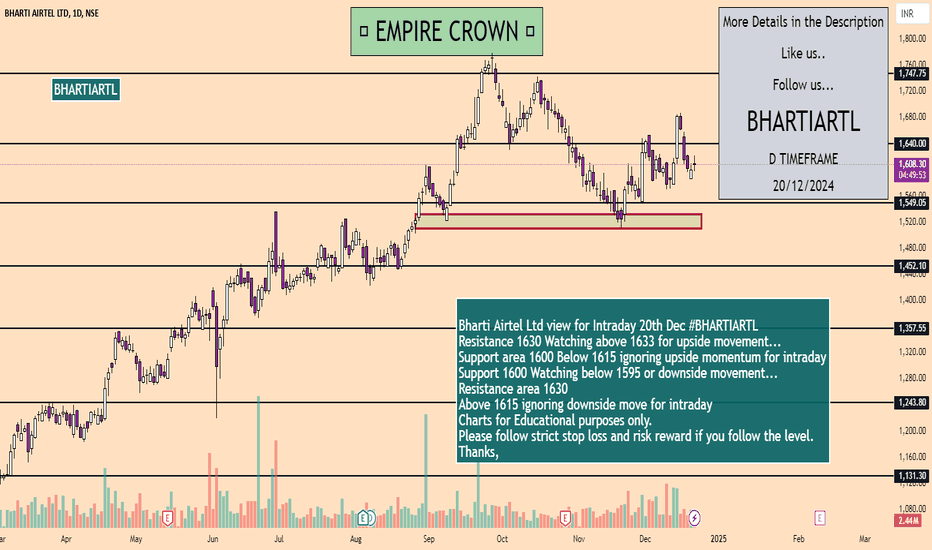

Bharti Airtel Ltd view for Intraday 22th Dec #BHARTIARTL

Bharti Airtel Ltd view for Intraday 22th Dec #BHARTIARTL

Resistance 1630 Watching above 1633 for upside movement...

Support area 1600 Below 1615 ignoring upside momentum for intraday

Support 1600 Watching below 1595 or downside movement...

Resistance area 1630

Above 1615 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

JSW Steel Ltd view for Intraday 22th Dec #JSWSTEEL

JSW Steel Ltd view for Intraday 22th Dec #JSWSTEEL

Resistance 960 Watching above 962 for upside movement...

Support area 940 Below 950 ignoring upside momentum for intraday

Support 940 Watching below 938 or downside movement...

Resistance area 960

Above 950 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

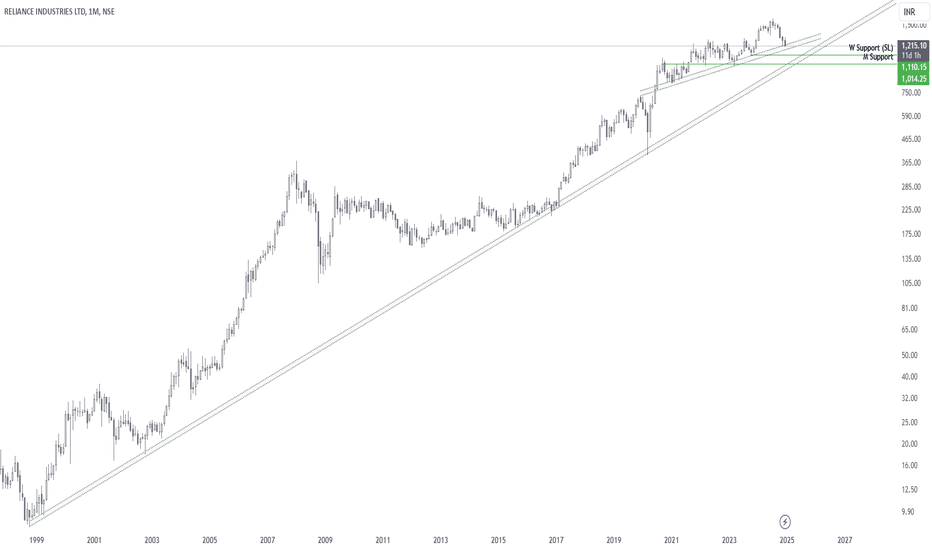

Reliance Industries Ltd view for Intraday 22th Dec #RELIANCE

Reliance Industries Ltd view for Intraday 22th Dec #RELIANCE

Resistance 1270 Watching above 1273 for upside movement...

Support area 1240 Below 1255 ignoring upside momentum for intraday

Support 1240 Watching below 1238 or downside movement...

Resistance area 1270

Above 1255 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

TATA Motors Ltd view for Intraday 22th Dec #TATAMOTORS

TATA Motors Ltd view for Intraday 22th Dec #TATAMOTORS

Resistance 770-773 Watching above 775 for upside movement...

Support area 750 Below 765 ignoring upside momentum for intraday

Support 750 Watching below 747 or downside movement...

Resistance area 770-773

Above 760 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Max Health Institute Ltd view for Intraday 22th Dec #MAXHEALTH

Max Health Institute Ltd view for Intraday 22th Dec #MAXHEALTH

Resistance 1220 Watching above 1222 for upside movement...

Support area 1200 Below 1200 ignoring upside momentum for intraday

Support 1200 Watching below 1198 or downside movement...

Resistance area 1220

Above 1220 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

PAYTM view for Intraday 22th Dec #PAYTM

PAYTM view for Intraday 22th Dec #PAYTM

Resistance 1020-1022 Watching above 1014 for upside movement...

Support area 990 Below 1000 ignoring upside momentum for intraday

Support 1000 Watching below 1010 or downside movement...

Resistance area 1010

Above 1000 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

RELIANCE ViewRELIANCE Chart Analysis

Monthly Chart shows it price is near trendline(TL) support. Need to watch what happens here.

Either Reverses from TL or falls upto 1000 monthly support.

RELIANCE at reversal Point + HDFCBANK at ATH BO retesting ---> Hope Nifty also moves higher.

Lets watch and see. Can trade in daily after reversal confirmation.

Note: No idea about Reliance fundamentals, anyway it is Bluechip stock.

How to get profit by option chain in trading For long calls: If the underlying is above the strike price on expiration, the profit is the underlying price on expiry – strike price – premium paid per contract. If the underlying is at or below the strike price on expiration, the option has no value so your loss is the premium paid to buy the call option.

Options trading can be one of the most lucrative ways to trade in the financial markets. Traders only have to put up a relatively small amount of money to take advantage of the power of options to magnify their gains, allowing them to multiply their money many times, often in weeks or months.

What is Option Chain ?Options chain can be defined as the listing of all option contracts. It comes with two different sections: call and put. A call option means a contract that gives you the right but does not give you the obligation to buy an underlying asset at a particular price and within the option's expiration date.

How does an option chain work? An option chain displays available call and put options for a specific underlying asset, with their strike prices, premiums, and open interest. It provides a snapshot of market sentiment and potential price movements.

OPTION TRADING When you trade options, you're essentially placing a bet on if a stock will decrease, increase or remain the same in value; how much it will deviate from its current price; and in what time those changes will occur. Based on those parameters, you can choose to enter into a contract to buy or sell a company's stock.

You don't need a considerable sum of money to become an options trader. You can start small with a capital of less than Rs 2 lakhs too. However, as you start small, you need to be a careful trader so that you can cut down on the possibility of losses and enhance the return potential of your trades.

DATABASE TRADING Trading data providers supply real-time and historical information relating to stocks and securities traded on various global financial exchanges. Opah Labs. Based in USA. Delivering deep proprietary industry data across a broad range of sectors to create cutting-edge insights.

Stock exchanges and data vendors are great sources for institutions. Retain traders can use broker APIs as it's more economical. As a trader, you must be quick and analytical, and good-quality data is the way to go

Vedanta Ltd view for Intraday 20th Dec #VEDL

Vedanta Ltd view for Intraday 20th Dec #VEDL

Resistance 523-524 Watching above 525 for upside movement...

Support area 505 Below 518 ignoring upside momentum for intraday

Support 505 Watching below 505 or downside movement...

Resistance area 523-524

Above 510 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

HDFCBANK Support & Resistance To determine the support and resistance levels for HDFC Bank (as of now, in December 2024), we would typically rely on technical analysis methods such as identifying recent swing highs and swing lows, using Fibonacci retracement levels, and observing moving averages and chart patterns. These levels change frequently, depending on market conditions, but I’ll provide a general guideline on how to calculate these levels and some typical support/resistance points that might be relevant.

How to Find HDFC Bank's Support & Resistance Levels:

Swing Highs and Lows: The most basic form of support and resistance is identifying the points on the price chart where HDFC Bank has recently bounced (support) or reversed down (resistance).

Support: Price level where the stock finds buying interest and reverses from a downtrend.

Resistance: Price level where the stock finds selling pressure and reverses from an uptrend.

Fibonacci Retracement Levels: Fibonacci retracement is a powerful tool to predict possible support and resistance levels. Typically, the key levels are:

23.6%

38.2%

50%

61.8%

These can be drawn by taking the most recent significant swing low and swing high (or vice versa) on the chart.

Moving Averages: Key moving averages like the 50-day, 100-day, or 200-day can serve as dynamic support or resistance levels. If the price is above the moving average, it often acts as support, and if the price is below, it often acts as resistance.

Psychological Levels: Round numbers such as ₹1,500, ₹1,600, ₹2,000, etc., often act as strong psychological barriers.

Volume: High-volume areas in the past can act as strong support/resistance zones.

Bank Nifty index Support & Resistance Support Levels:

Support levels are price points where the Bank Nifty index tends to find buying interest. These are levels where the index has historically reversed or slowed down its decline.

Recent Swing Lows: Look for the recent lowest points on the chart where the price has bounced back.

Fibonacci Retracement Levels: Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) are often used to identify potential support zones.

Moving Averages: Key moving averages like the 50-day, 100-day, or 200-day moving average can act as dynamic support levels.

2. Resistance Levels:

Resistance levels are price points where selling pressure tends to emerge, preventing the price from rising further.

Recent Swing Highs: Look for points where the index has faced difficulty breaking through or has reversed from the upside.

Fibonacci Retracement Levels: Similarly, Fibonacci levels can also help identify potential resistance areas.

Psychological Levels: Round numbers or large milestones in the Bank Nifty's price (like 40,000, 45,000, etc.) often act as resistance.

Trendlines: A downward-sloping trendline can act as resistance, especially if it intersects with recent highs.

Cipla Ltd view for Intraday 20th Dec #CIPLA

Cipla Ltd view for Intraday 20th Dec #CIPLA

Resistance 1460-1463 Watching above 1465 for upside movement...

Support area 1430 Below 1440 ignoring upside momentum for intraday

Support 1430 Watching below 1428 or downside movement...

Resistance area 1460-1463

Above 1440-1445 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Bharti Airtel Ltd view for Intraday 20th Dec #BHARTIARTL

Bharti Airtel Ltd view for Intraday 20th Dec #BHARTIARTL

Resistance 1630 Watching above 1633 for upside movement... Support area 1600 Below 1615 ignoring upside momentum for intraday

Support 1600 Watching below 1595 or downside movement...

Resistance area 1630

Above 1615 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

JSW Steel Ltd view for Intraday 20th Dec #JSWSTEEL

JSW Steel Ltd view for Intraday 20th Dec #JSWSTEEL

Resistance 960 Watching above 962 for upside movement...

Support area 940 Below 950 ignoring upside momentum for intraday

Support 940 Watching below 938 or downside movement...

Resistance area 960

Above 950 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Reliance Industries Ltd view for Intraday 20th Dec #RELIANCE

Reliance Industries Ltd view for Intraday 20th Dec #RELIANCE

Resistance 1270 Watching above 1273 for upside movement...

Support area 1240 Below 1255 ignoring upside momentum for intraday

Support 1240 Watching below 1238 or downside movement...

Resistance area 1270

Above 1255 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,