KSL Daily and Weekly breakout 34% upmove possibleThis is price breakout stategy . you can use different timeframes as daily, weekly, monthly .

I scan stocks daily and try to find breakout structure after long consolidation and confirms with different timeframe and then draws some levels as price action then we make a perfect plan for entry, stoploss and target

If you like my ideas then support me .

Community ideas

krishna defence - next bull run is coming soonTrade Setup - KRISHNADEF (NSE)

Scenario: Bullish breakout from a rounding bottom pattern with a close above the 50% Fibonacci retracement level.

Entry:

Trigger: A candlestick close above ₹723 (the 50% Fibonacci level). This confirms a break above the rounding bottom pattern and suggests strong upward momentum.

Confirmation (Optional): You could wait for a second confirming candle close above ₹723 to further validate the breakout.

Stop Loss:

₹630.00 (as marked on the chart). This limits your risk by defining the point at which you'll exit the trade if the price moves against you.

Targets:

Target 1: ₹811 (38.2% Fibonacci retracement) - A common first target in this scenario.

Target 2: ₹919 (23.6% Fibonacci retracement) - A more ambitious target if momentum continues.

Target 3: ₹1,095.60 (as marked on the chart) - The most ambitious target, potentially based on previous resistance or a significant Fibonacci extension level.

Rationale:

Rounding Bottom: This pattern suggests a gradual shift in sentiment from bearish to bullish, with the potential for a significant upward move.

Fibonacci Confluence: The 50% retracement level is a key level in Fibonacci analysis. A break above it adds to the bullish case.

Stop Loss Placement: The stop loss below the recent swing low helps protect your capital if the breakout fails.

Trade Management:

Trailing Stop: Consider using a trailing stop loss to lock in profits as the price moves in your favor. You could trail your stop loss below the most recent swing low or use a moving average.

Partial Profits: You could take partial profits at each target level to reduce risk and secure some gains.

Important Considerations:

Timeframe: The timeframe of this chart is crucial. If it's a weekly chart, this setup implies a longer-term trade. A daily chart suggests a shorter-term trade.

Volume: Observe volume during the breakout. Increasing volume adds conviction to the move.

News and Events: Be aware of any news or events that could impact the stock price.

Risk Management: Only risk capital you can afford to lose. This trade setup, like any other, has no guaranteed outcome.

Dabur India Stock at a Critical JunctureDabur India Ltd., a leading FMCG player, is showing an interesting technical setup on its weekly chart.

Key Highlights:

Strong Support: The stock has consistently respected a long-term ascending trendline since 2012.

Triangle Pattern: A descending triangle is forming, signaling potential breakout or breakdown.

Current Level: Trading at INR 507.50, near critical support at the trendline.

Outlook:

Bullish Case: A breakout above the triangle could target INR 680.

Bearish Case: A breakdown below INR 480 may signal further downside.

Bullish Breakthroughs: 3 Stocks Marching Towards Big Gains1. Pricol NSE:PRICOLLTD

● Pricol's stock price has formed a Rounding Bottom Pattern, signalling a potential trend continuation.

● Following a successful breakout, the stock has resumed its upward trajectory, suggesting further gains.

2. Prestige Estate NSE:PRESTIGE

● A bullish Pole & Flag Pattern has emerged on Prestige Estate's chart.

● The recent breakout is likely to propel the price to higher levels, presenting a buying opportunity.

3. Borosil Renewables NSE:BORORENEW

● Borosil Renewables' stock price has formed a Falling Wedge (Continuation) Pattern after undergoing a prolonged consolidation phase.

● The recent breakout suggests a significant upward move, positioning the stock for substantial gains.

Breakout @Bajaj Healthcare Ltd.

STOCK: Bajaj healthcare ltd.

SETUP: Multiyear Break out, Range Break out. Stock was facing resistance of 500 since 2022, now nicely given breakout with positive close

VOLUME: Huge volume on Breakout candle

PLAN: Entry: Above day high or wait for retest the 500 and find the entry with good R:R, STOP: low of the breakout candle i.e. 465 (stop is quite big manage your quantity accordingly

TARGET: 1:2 or 1:1.7 according to range i.e. 735

NOTE: For Learning purposes only # Manage your Risk

NOTE: Will not update on same setup, Take STOP or Take Target

Lupin: Decline After Highs Offers Buying Potential Topic Statement: Lupin faces selling pressure after reaching its lifetime high in 2024, with the price slowly declining in a channel.

Key Points:

1. The stock price is falling within a down-trending channel.

2. The price is nearing the 180-day moving average, presenting a good buying opportunity at or below this level.

ICICI bank Selling Pressure and ConsolidationHaving its median around 1340 for 18th Dec , and previous closing at 1333.75 , May open higher or at the closing the next day if the Selling Pressure continues it may reach till 1314 which act as a very strong support , at weekly and monthly also , but the trend for icici may change to Bearish .

Average Volume and price decline indicates Short build up , bearish sentiments may continue if the bank nifty is in selling pressure .

Stock Analysis: Yatra Online LimitedIntroduction:

Yatra Online Limited serves both local and foreign clients by providing them with information, prices, availability, and the opportunity to book. In terms of both corporate clients and online booking income, Yatra ranks third in India, and it is the biggest corporate travel services supplier in the country. With the most hotels as of FY24, Yatra is the leader.

Fundamentals:

Market Cap: ₹ 1,844 Cr.

Stock P/E: 103 Ind.P/E: 90.66

Book Value: ₹ 48.4 Dividend Yield: 0.00 %

ROCE: 3.54 % ROE: -1.00 %

Sales Growth 3 Years: 50% Profit Growth 3 Years: 25%

Cons: High PE (PE > 40), Companies with weak financials,

Technicals:

Yatra has been in a downtrend since Feb 2024.

It successfully tested the support level of 103 in Dec 2024 and rebounded strongly.

The stock has given a positive breakout with good volume.

The bullish trend can be confirmed once the 20 EMA (Black Line) traverses past 50 EMA (Orange Line) and 100 EMA (Sky Blue Line) in the weekly closing.

Resistance levels: 127, 157, 182, 194

Support levels: 116.5, 103.5

Godrej Properties: Ready for a Big Move?➡️ Price Analysis & Overview:

1️⃣ 2.5-Year BO & Retest: Godrej Properties has recently broken out of a long consolidation phase and is currently retesting the breakout zone, signaling potential for a strong upward rally.

2️⃣ Favourable RRR: The risk-reward ratio is attractive, with limited downside and significant upside potential.

3️⃣ Volume Strength: Current volumes are decent, but a spike in buying activity could confirm momentum.

4️⃣ Technical Structure: The stock has maintained a bullish structure, respecting key support levels consistently.

✨ My Trade Plan:

1️⃣ I expect the bullish momentum to continue, with a potential 30% upside from the current levels.

2️⃣ 1:3 RRR

⚠️ Disclaimer: This analysis is for educational purposes only. Always conduct your research before making any trading decisions.

What are your views on Godrej Properties? Let’s discuss in the comments!

Thanks & Regards,

Anubrata Ray ⚡

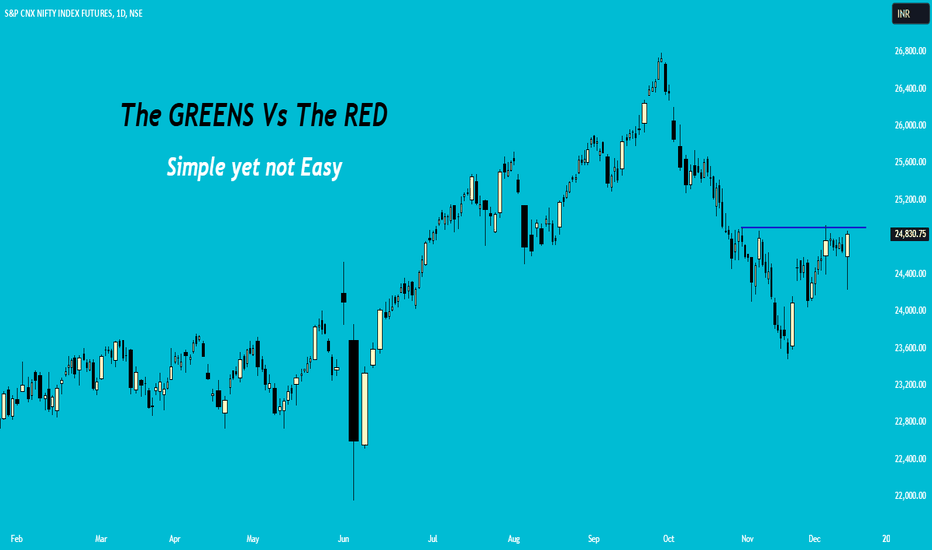

The GREENS Vs The REDThere are two most important and fundamental questions that every trader should ask to himself and should not put his hard-earned money in the market before answering them.

>> The first one is why more than 95-98% traders lose money in the market?

>> And the second one is How those 2-5% traders are still able to make money in the market?

🤔 Is it about fundamental or technical analysis that fill this gap here or is it something else that is ignored on part of the losing traders?

Well one can be a good analyst who mastered those arts in months or over years but may still lose 🎃 when it comes to real trading.

Social media has made it too easy to learn analysis but trading still keeps its difficult spot in the real world.

The space 📏 between the winners and the losers is surely more about discipline and consistency.

Losers generally lose because of fear or greed.

Fear 😣 could be of missing the trade, so entering too early or could be of losing a winning trade and always exiting with minor profit. Both scenarios lead to damage when trade goes against the expected direction.

Greed 🤑 may result into keep on holding a losing trade in hope or not booking good profit in the hope of more and then booking loss. Greed may also lead to unacceptably higher position sizes or over-trading. One should not forget that greed in a good cause is still greed and can damage capital in trading.

Both greed and fear lead to lousy decision making and hence loss in almost all cases.

Winning approach is more about discipline. It is to know one's reasons for trading. These reasons could be their tested setups- No setup, no trade.

Its also about knowing when to stop 🤚. Stop when a defined loss in a trade reaches or stop when specific number of trades are lost.

Winners 🥇 understand that there is no perfect exit when in profit. Either exit at a target or at least with some profit. Protecting capital, without overtrading, could boosts confidence in future trades.

Hence the task of winning more can be achieved by losing less with the above-mentioned approach. One can also lose less by keeping (acceptably) wider stop and hence limiting the number of trades by by-passing volatility.

I hope this would make sense for some traders.

Do boost 🚀 comment below to get educational ideas more frequently.

Regards.

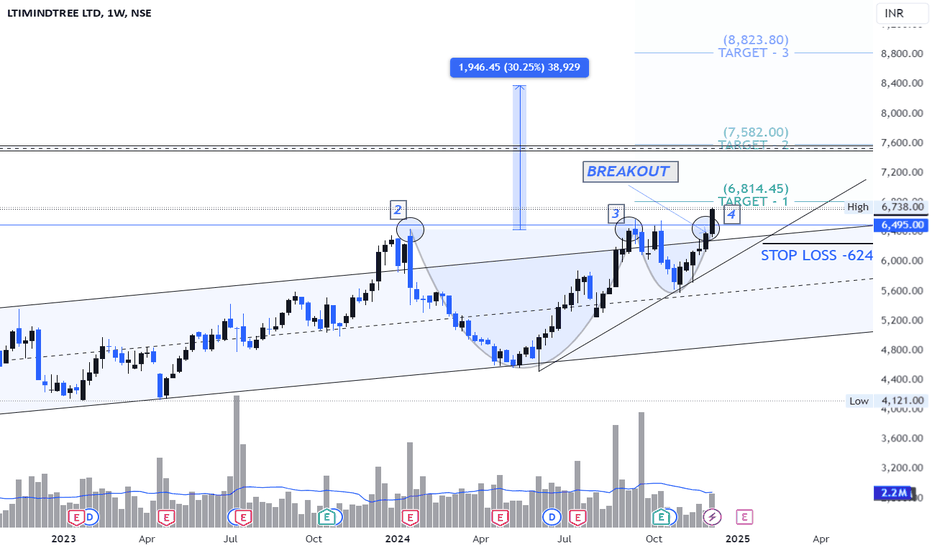

LTIM - LTIMindtree and GitHub Forge Strategic Partnership to DriLTIMindtree Announces Strategic Partnership with GitHub

LTIMindtree has announced a strategic partnership with GitHub. This collaboration aims to integrate GitHub’s advanced DevOps and AI-driven pair programming capabilities with LTIMindtree’s expertise in digital engineering and AI transformation. The synergy between these two entities is expected to create a robust ecosystem that will drive enterprise innovation at scale.

Technical Analysis

The chart structure indicates a bullish trend, characterized by a cup and handle pattern. A breakout has already occurred.

Buy Range : ₹6550 - ₹6750

Stop Loss : Tailing trendline or ₹6250

Target : Open / As mentioned on Chart

DCB Bank Weekly Chart AnalysisDCB Bank is showing a promising breakout potential on the weekly time frame with an inside bar formation! 📈🚀 Technical analysis suggests that the stock is poised to break out of its trendline, indicating a possible upward move. Keep an eye on this setup and consider it for your trading strategy. This is an educational post. Not a buy/sell Call.

#DCBBank #TechnicalAnalysis #BreakoutAlert #InsideBar #TradingStrategy

120121 Triangle breakoutTrade Thesis

a) Triangle breakout

b) HSP breakout

c) pole and flag set up

d) RSI positive

e) mini pole and flag set up

g) Weekly breakout possible

h) Long above 2255 and closing above first 5 min on monday is good long otherwise skip the trade

i) SL compulsory

j) Duration 1 week only

Trading mindset requirements

a) The key Characteristics of a Winning Trader are Psychologically , the very best of traders share the same key characteristics, including the following: are

1. They are all comfortable with taking risks and dont mind if the system provide losses in single trade.

2. The losing trades are simply part of the game of trading.

3. Winning traders are able to emotionally accept the uncertainty that is inherent in trading.

4.Trading is not like investing your money in a savings account with a guaranteed return.

5.Winners are capable of quickly adjusting to changing market conditions.

6.They don’t fall in love with, and “marry”, their analysis of a market. If price action indicates that they need to change their view on probable future price movements, they do so without hesitating.

7.Winner don’t give in to being excessively excited about winning trades or excessively despairing about losing trades.

8.Winning traders control their emotions rather than letting their emotions control them.

9. Winning traders carefully calculate potential risk against potential reward before entering any trade.

10. One of the most important psychological characteristics of winning traders is the ability to accept (1) risk and (2) the fact that you may well be wrong more often than you are right in initiating trades.

11. Winning traders understand that trade management in trade life cycle is actually a more important skill than market analysis.

12. What determines profits and losses is often not so much a matter of how or when you enter a trade, but much more a matter of how you manage a trade once you’re in it .

Anant Raj Ltd – Potential Breakout Setup📊 Analysis:

The stock is consolidating near a key resistance level at ₹759.90, forming a contracting range. This pattern indicates a potential breakout opportunity. The price is supported by the 21-EMA and 50-EMA, which are trending upwards, signaling bullish momentum.

📈 Trading Plan:

Entry: Buy above ₹760 (wait for a breakout above resistance with strong volume confirmation).

Target 1: ₹800

Target 2: ₹836

Stop-Loss: ₹723 (below recent swing low for risk management).

🛑 Risk-to-Reward Ratio: Approx. 1:2

💡 Note: Monitor the breakout closely. A failure to sustain above ₹760 might lead to a false breakout, so trade cautiously and stick to the plan.

Bank nifty trades and targets - 12/12/24continuation of trend. If it opens gap up then we need to see the resistance level to break before looking for CE trades. If it opens gap down then look for PE trades after support zone is broken. Let the market settle in first 15 to 30 minutes then look for directional trades. Book profits every 60 points as we are getting very few trending moves.

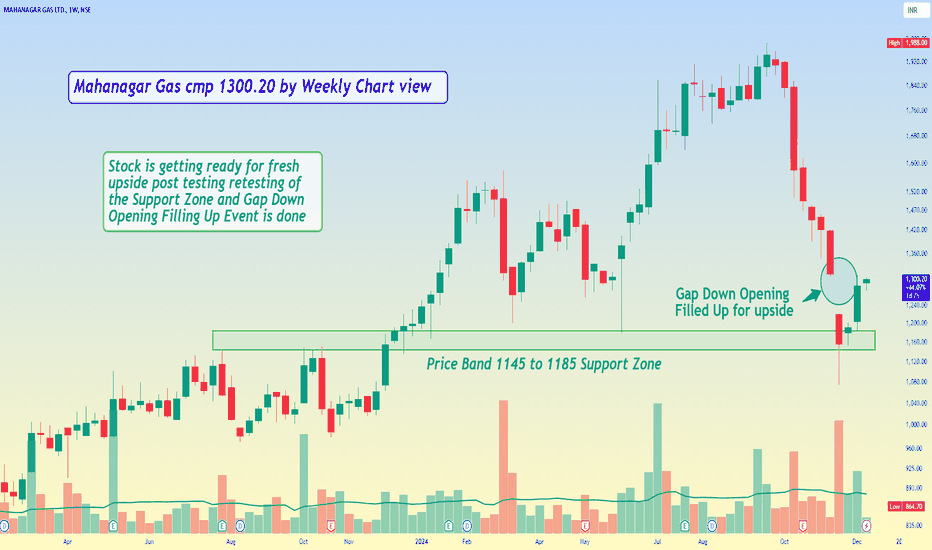

Mahanagar Gas cmp 1300.20 by Weekly Chart viewMahanagar Gas cmp 1300.20 by Weekly Chart view

- Price Band 1145 to 1185 Support Zone

- Gap Down Opening Filled Up for fresh upside

- Stock is getting ready for fresh upside post testing retesting of the Support Zone and Gap Down Opening Filling Up Event is done

IGL has given beautiful Trendline Resistance BreakoutIGL - Price Action Analysis and Observations

* CMP 392.00

* Trendline resistance breakout with volumes slowly increasing

* Multiple touches on the trendline

* Gap zone 403 might be filled first

* An hourly close above 405 would be sufficient to reach 440-445

* Once 440 is reached we will see how the candles react and then decide

whether it will reach 480-500

* SL could be below 360 on hourly closing basis

Thanks.

Regards

Bull Man

WIPRO - broken out of an Ascending Wedge patternASCENDING WEDGE PATTERN -

wipro has broken out of ascending wedge pattern with gap-up opening indicating strong bullish momentum for the stock

100D MOVING AVERAGE -

price has tested the 100D simple moving average several times and have gone upwards indicating strong potential for upward movement

HIGHER HIGHS & HIGHER LOWS -

price has formed multiple higher highs & higher lows indicating price is having bullish momentum

TARGET PRICE -

price will go till 317 level

CHOLAMANDALAM FINANCEAfter the correction waves in the mark down stage of the price action, the accumulation phase is complete with a Head and Shoulder pattern. There is assurance in the base formation by way of a double bottom. The stock may not race fast enough but the trajectory seems to have turned bullish.

Looking for Penny stocks to invest, have a look!! AIRAN LTDA glimpse of our analysis on AIRAN LTD chart on Daily Time frame.

1)We have price reacting to the weekly order block and Fvg and giving a good move upward with good volume indicating Smart money orders coming in.

2)Down charting on 1Day time frame, we were able to spot a Change in market structure. Shift of trend from bearish to bullish.

1WEEK TIME FRAME — BULLISH

1DAY TIMEFRAME — SHIFTED FROM BEARISH TO BULLISH

We are waiting for price to react back from FVG or ORDER BLOCK and ride with the trend targeting T1, T2, T3 and weekly High as the final target.

This is for educational purposes only. Please do your own research before investing.