Account and customer tax IDs with Invoicing

Learn about storing, validating, and rendering tax ID numbers for Invoicing.

With Stripe, you can manage tax IDs for both yourself and your customers. Both the account and customer tax IDs display in the header of invoice and credit note PDFs.

Account tax IDs

Displaying your tax IDs on invoice documents is a common regulatory requirement.

With Stripe, you can add up to 25 tax IDs to your account. You can see your tax IDs in the header of invoice and credit note PDFs. You can:

- Select default tax IDs to appear on every invoice and credit note PDF.

- Define a list of tax IDs to appear on a specific invoice.

Caution

You can’t add, change, or remove account tax IDs after an invoice is finalized.

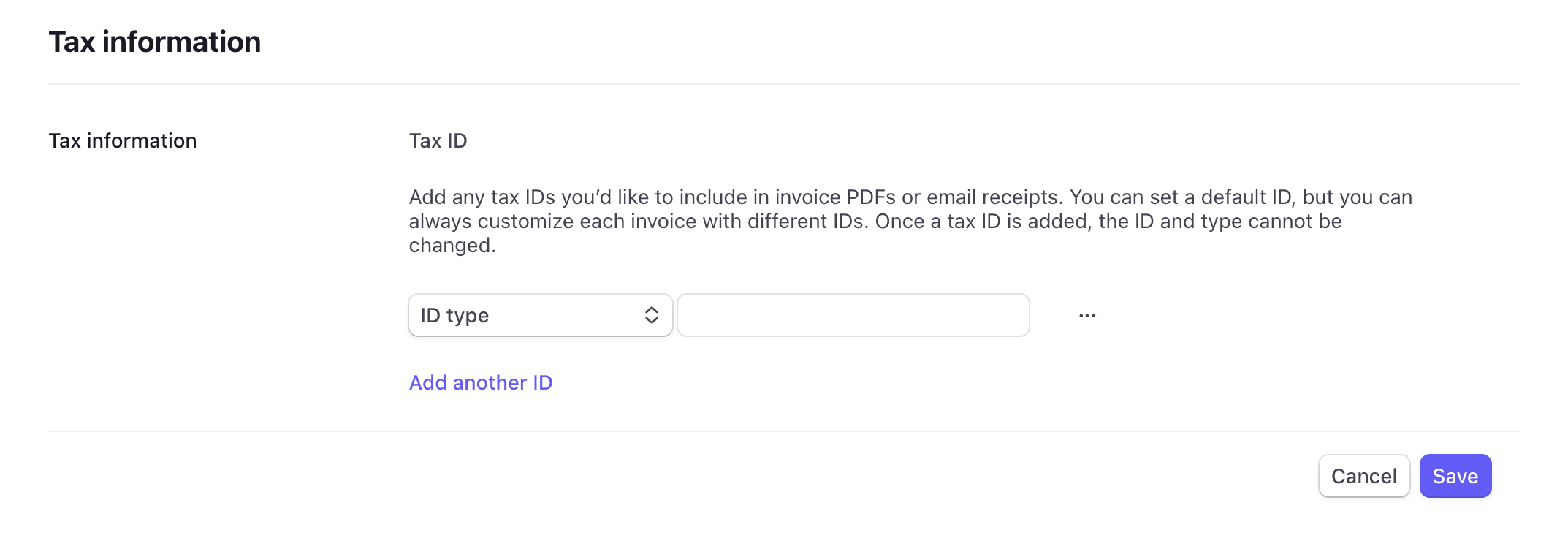

Managing account tax IDs

You can add and delete tax IDs using the invoice settings page in the Dashboard. After you add a tax ID in the Dashboard, you can set it as the default tax ID for every invoice and credit note PDF. Tax IDs are immutable—you can’t change the country and ID after you save the tax ID to your account.

Additionally, you can add and delete tax IDs with the create and delete endpoints.

Adding and removing IDs

Setting default tax IDs

On the invoice settings page, click the Tax tab and locate the tax ID you want to set as the default. Click the overflow menu (), select Set as default, and click Save.

Set default account tax ID in the Dashboard

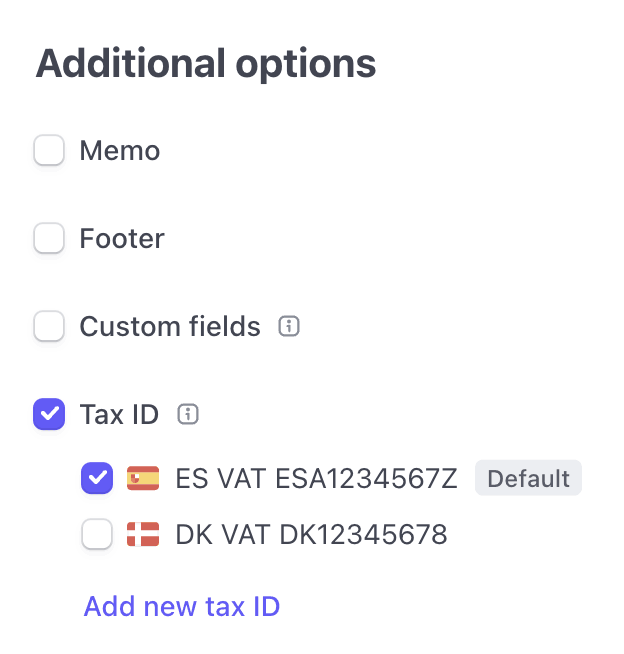

After you set a tax ID as the default, you can see a label in the tax information box:

A default account tax ID in the Dashboard

Displaying tax IDs on invoices

Stripe automatically pulls your default tax IDs during invoice finalization.

To override the default and display multiple tax IDs on invoices, you can set tax IDs in the Dashboard or by using the API. To learn more about taxes and invoices, see Taxes.

Customer tax IDs

Collecting and displaying a customer’s tax ID on an invoice is a common requirement for B2B sales. With Stripe, you can add up to five tax IDs to a customer. You can see a customer’s tax IDs in the header of invoice and credit note PDFs. You can collect a tax ID with Stripe Checkout, or pass us a tax ID directly.

Supported tax ID types

Note

Need another tax ID type? Request additional tax ID types by emailing us at [email protected].

Currently, Stripe supports the following tax ID types in the following regions:

| Country | Enum | Description | Example |

|---|---|---|---|

| Andorra | ad_ | Andorran NRT number | A-123456-Z |

| Argentina | ar_ | Argentinian tax ID number | 12-3456789-01 |

| Australia | au_ | Australian Business Number (AU ABN) | 12345678912 |

| Australia | au_ | Australian Taxation Office Reference Number | 123456789123 |

| Austria | eu_ | European VAT number | ATU12345678 |

| Bahrain | bh_ | Bahraini VAT Number | 123456789012345 |

| Belarus | by_ | Belarus TIN Number | 123456789 |

| Belgium | eu_ | European VAT number | BE0123456789 |

| Bolivia | bo_ | Bolivian tax ID | 123456789 |

| Brazil | br_ | Brazilian CNPJ number | 01.234.456/5432-10 |

| Brazil | br_ | Brazilian CPF number | 123.456.789-87 |

| Bulgaria | bg_ | Bulgaria Unified Identification Code | 123456789 |

| Bulgaria | eu_ | European VAT number | BG0123456789 |

| Canada | ca_ | Canadian BN | 123456789 |

| Canada | ca_ | Canadian GST/HST number | 123456789RT0002 |

| Canada | ca_ | Canadian PST number (British Columbia) | PST-1234-5678 |

| Canada | ca_ | Canadian PST number (Manitoba) | 123456-7 |

| Canada | ca_ | Canadian PST number (Saskatchewan) | 1234567 |

| Canada | ca_ | Canadian QST number (Québec) | 1234567890TQ1234 |

| Chile | cl_ | Chilean TIN | 12.345.678-K |

| China | cn_ | Chinese tax ID | 123456789012345678 |

| Colombia | co_ | Colombian NIT number | 123.456.789-0 |

| Costa Rica | cr_ | Costa Rican tax ID | 1-234-567890 |

| Croatia | eu_ | European VAT number | HR12345678912 |

| Croatia | hr_ | Croatian Personal Identification Number | 12345678901 |

| Cyprus | eu_ | European VAT number | CY12345678Z |

| Czech Republic | eu_ | European VAT number | CZ1234567890 |

| Denmark | eu_ | European VAT number | DK12345678 |

| Dominican Republic | do_ | Dominican RCN number | 123-4567890-1 |

| Ecuador | ec_ | Ecuadorian RUC number | 1234567890001 |

| Egypt | eg_ | Egyptian Tax Identification Number | 123456789 |

| El Salvador | sv_ | El Salvadorian NIT number | 1234-567890-123-4 |

| Estonia | eu_ | European VAT number | EE123456789 |

| EU | eu_ | European One Stop Shop VAT number for non-Union scheme | EU123456789 |

| Finland | eu_ | European VAT number | FI12345678 |

| France | eu_ | European VAT number | FRAB123456789 |

| Georgia | ge_ | Georgian VAT | 123456789 |

| Germany | de_ | German Tax Number (Steuernummer) | 1234567890 |

| Germany | eu_ | European VAT number | DE123456789 |

| Greece | eu_ | European VAT number | EL123456789 |

| Hong Kong | hk_ | Hong Kong BR number | 12345678 |

| Hungary | eu_ | European VAT number | HU12345678 |

| Hungary | hu_ | Hungary tax number (adószám) | 12345678-1-23 |

| Iceland | is_ | Icelandic VAT | 123456 |

| India | in_ | Indian GST number | 12ABCDE3456FGZH |

| Indonesia | id_ | Indonesian NPWP number | 012.345.678.9-012.345 |

| Ireland | eu_ | European VAT number | IE1234567AB |

| Israel | il_ | Israel VAT | 000012345 |

| Italy | eu_ | European VAT number | IT12345678912 |

| Japan | jp_ | Japanese Corporate Number (*Hōjin Bangō*) | 1234567891234 |

| Japan | jp_ | Japanese Registered Foreign Businesses' Registration Number (*Tōroku Kokugai Jigyōsha no Tōroku Bangō*) | 12345 |

| Japan | jp_ | Japanese Tax Registration Number (*Tōroku Bangō*) | T1234567891234 |

| Kazakhstan | kz_ | Kazakhstani Business Identification Number | 123456789012 |

| Kenya | ke_ | Kenya Revenue Authority Personal Identification Number | P000111111A |

| Latvia | eu_ | European VAT number | LV12345678912 |

| Liechtenstein | li_ | Liechtensteinian UID number | CHE123456789 |

| Liechtenstein | li_ | Liechtensteinian VAT number | 12345 |

| Lithuania | eu_ | European VAT number | LT123456789123 |

| Luxembourg | eu_ | European VAT number | LU12345678 |

| Malaysia | my_ | Malaysian FRP number | 12345678 |

| Malaysia | my_ | Malaysian ITN | C 1234567890 |

| Malaysia | my_ | Malaysian SST number | A12-3456-78912345 |

| Malta | eu_ | European VAT number | MT12345678 |

| Mexico | mx_ | Mexican RFC number | ABC010203AB9 |

| Moldova | md_ | Moldova VAT Number | 1234567 |

| Morocco | ma_ | Morocco VAT Number | 12345678 |

| Netherlands | eu_ | European VAT number | NL123456789B12 |

| New Zealand | nz_ | New Zealand GST number | 123456789 |

| Nigeria | ng_ | Nigerian Tax Identification Number | 12345678-0001 |

| Norway | no_ | Norwegian VAT number | 123456789MVA |

| Norway | no_ | Norwegian VAT on e-commerce number | 1234567 |

| Oman | om_ | Omani VAT Number | OM1234567890 |

| Peru | pe_ | Peruvian RUC number | 12345678901 |

| Philippines | ph_ | Philippines Tax Identification Number | 123456789012 |

| Poland | eu_ | European VAT number | PL1234567890 |

| Portugal | eu_ | European VAT number | PT123456789 |

| Romania | eu_ | European VAT number | RO1234567891 |

| Romania | ro_ | Romanian tax ID number | 1234567890123 |

| Russia | ru_ | Russian INN | 1234567891 |

| Russia | ru_ | Russian KPP | 123456789 |

| Saudi Arabia | sa_ | Saudi Arabia VAT | 123456789012345 |

| Serbia | rs_ | Serbian PIB number | 123456789 |

| Singapore | sg_ | Singaporean GST | M12345678X |

| Singapore | sg_ | Singaporean UEN | 123456789F |

| Slovakia | eu_ | European VAT number | SK1234567891 |

| Slovenia | eu_ | European VAT number | SI12345678 |

| Slovenia | si_ | Slovenia tax number (davčna številka) | 12345678 |

| South Africa | za_ | South African VAT number | 4123456789 |

| South Korea | kr_ | Korean BRN | 123-45-67890 |

| Spain | es_ | Spanish NIF number (previously Spanish CIF number) | A12345678 |

| Spain | eu_ | European VAT number | ESA1234567Z |

| Sweden | eu_ | European VAT number | SE123456789123 |

| Switzerland | ch_ | Switzerland UID number | CHE-123.456.789 HR |

| Switzerland | ch_ | Switzerland VAT number | CHE-123.456.789 MWST |

| Taiwan | tw_ | Taiwanese VAT | 12345678 |

| Tanzania | tz_ | Tanzania VAT Number | 12345678A |

| Thailand | th_ | Thai VAT | 1234567891234 |

| Turkey | tr_ | Turkish Tax Identification Number | 0123456789 |

| Ukraine | ua_ | Ukrainian VAT | 123456789 |

| United Arab Emirates | ae_ | United Arab Emirates TRN | 123456789012345 |

| United Kingdom | eu_ | Northern Ireland VAT number | XI123456789 |

| United Kingdom | gb_ | United Kingdom VAT number | GB123456789 |

| United States | us_ | United States EIN | 12-3456789 |

| Uruguay | uy_ | Uruguayan RUC number | 123456789012 |

| Uzbekistan | uz_ | Uzbekistan TIN Number | 123456789 |

| Uzbekistan | uz_ | Uzbekistan VAT Number | 123456789012 |

| Venezuela | ve_ | Venezuelan RIF number | A-12345678-9 |

| Vietnam | vn_ | Vietnamese tax ID number | 1234567890 |

Validation

It’s your responsibility to make sure customer information is accurate (including their tax ID). Stripe displays a customer tax ID on an invoice, whether or not it is valid.

Stripe checks the format of the tax ID against the expected format, and asynchronously validates the tax ID against the external tax authority system for the tax ID types below.

Australian Business Numbers (ABN)

Stripe automatically validates all Australian Business Numbers (ABNs) with the Australian Business Register (ABR).

European Value-Added-Tax (EU VAT) Numbers

Stripe automatically validates all European Value-Added-Tax (EU VAT) numbers with the European Commission’s VAT Information Exchange System (VIES). This process only validates whether or not the tax ID is valid—you still need to verify the customer’s name and address to make sure it matches the registration information.

VIES validation usually takes only a few seconds,but may take longer, depending on the availability of the external tax authority system. Stripe will automatically handle VIES downtime and attempt retries for you.

United Kingdom Value-Added-Tax (GB VAT) Numbers

Stripe automatically validates all UK Value-Added-Tax (GB VAT) numbers with the United Kingdom’s Revenue & Customs (HMRC). This process only verifies that the tax ID is valid—you still need to verify the customer’s name and address to make sure it matches the registration information.

HMRC validation usually takes only a few seconds, but may take longer, depending on the availability. Stripe automatically handles HMRC downtime and attempts retries for you.

Validation webhooks and Dashboard display

Because this validation process happens asynchronously, the customer.tax_id.updated webhook notifies you of validation updates.

The Dashboard displays the results of the validation while displaying the customer details, including those returned from the government databases and the registered name and address.

When automatic validation isn’t available, you need to manually verify these IDs.

Managing customer tax IDs

You can manage tax IDs in the Customers page in the Dashboard, in the customer portal, or with the API.